Central Florida Home Deals

Your Home Sold Guaranteed or We'll Buy It!*

Each month, we publish a series of articles of interest to homeowners -- money-saving tips, household safety checklists, home improvement advice, real estate insider secrets, etc. Whether you currently are in the market for a new home, or not, we hope that this information is of value to you. Please feel free to pass these articles on to your family and friends.

In This Issue:

-

Why Schools And Amenities Matter Even If You Don’t Have Kids — How school quality and local amenities impact property value, buyer demand, and long-term resale potential for everyone.

Read More » -

How To Buy Your Dream Home Without Overpaying — Learn smart pricing research, strategic bidding, and how to win without blowing your budget.

Read More » -

Multiple Offers: How To Pick The Right One Not Just The Highest — Not all offers are created equal. Compare financing, contingencies, and timelines to choose the one most likely to close smoothly.

Read More »

Why Schools And Amenities Matter Even If You Don’t Have Kids

Summary

School quality and local amenities don’t just benefit families, they impact property value, buyer demand, and long-term resale potential for everyone. This report explains why these factors matter even if you don’t have kids, and how they shape both your lifestyle and investment. Whether you’re buying or selling, location decisions matter more than you think.

It’s common to assume that school districts and neighborhood amenities only matter to families with children. But in reality, these features affect every buyer and seller, because they influence demand, quality of life, and ultimately, property value.

Here’s how (and why) schools and amenities shape smart real estate decisions:

1. Schools Influence Property Value

1. Schools Influence Property Value

Homes in strong school zones tend to:

- Sell faster

- Retain value better during downturns

- Attract more offers

Even if you don’t plan to use the local school, buyers with children likely will and that demand drives price and competition.

2. Great Amenities Build DesirabilityProximity to walkable amenities, such as:

- Grocery stores and coffee shops

- Parks and recreational trails

- Transit stations and commuter access

- Restaurants and fitness centers

adds daily convenience and long-term appeal. The “15-minute neighborhood” concept is increasingly popular, especially with remote and hybrid workers.

3. Your Future Buyer May Care More Than You DoEven if schools or parks aren’t a priority for you today, the next person who buys your home may place them at the top of their list. Buying with resale in mind is a smart move, especially if you plan to sell in the next 5-10 years.

4. Walkability = Lifestyle + ValueBeing near amenities isn’t just about price, it’s about how you live. Shorter drives, more walkable errands, and better access to services all improve quality of life. And in many markets, walkability boosts demand and leads to higher property appreciation.

5. Better Neighborhoods Often Mean Better UpkeepAreas with strong schools and desirable amenities tend to have:

- Higher owner occupancy rates

- Better-maintained homes and landscaping

- More community involvement

These factors create a “halo effect” that benefits everyone.

6. Rentals and Investment Property ConsiderationsIf you’re buying to rent, school ratings and neighborhood features affect:

- Tenant pool

- Rentability

- Rental income stability

- Vacancy rate

Many renters will pay more to live near a good school, even if you wouldn’t.

7. How to Evaluate These Factors- School rating sites (GreatSchools, Fraser Institute, etc.)

- Municipal plans for new parks, transit, or shopping

- Drive time apps for commutes and accessibility

- Walk Score or Transit Score for lifestyle convenience

- Talk to neighbors or real estate agents for local insight

Buying in an area with weak schools or minimal infrastructure might:

- Limit your resale audience

- Cap appreciation potential

- Increase time on market when you sell

Unless you’re buying long-term or at a significant discount, these compromises could hurt your investment.

Conclusion:

Schools and amenities aren’t just nice-to-haves, they’re silent influencers of property value, buyer demand, and livability. Even if they don’t affect your lifestyle directly, they affect your real estate bottom line. Always consider what future buyers will value and position yourself for the best return.

How To Buy Your Dream Home Without Overpaying

Summary

In competitive markets, buyers often feel pressured to bid high, but that can lead to overpayment and financial stress. This guide walks you through smart pricing research, strategic bidding, and how to recognize when it’s time to walk away. With tips from real estate pros and negotiation experts, you’ll learn to win without blowing your budget. Perfect for buyers who want to be aggressive but still sensible.

Buying your dream home is one of life’s most rewarding experiences, but it can quickly turn sour if you overpay. In a competitive market, bidding wars and emotional attachment can cause buyers to stretch their budget too far. However, with careful planning and smart strategy, you can land the home you want, without spending more than you should. This guide outlines everything you need to know to buy wisely, avoid common pricing pitfalls, and keep your finances intact.

Understand the Market First

Understand the Market First

The foundation of a smart home purchase is understanding your market. Is it a buyer’s or seller’s market? What’s the average price per square foot in your area? Are homes typically selling above or below the asking price? Research recent comparable sales and days on market. Partner with an experienced agent who understands local trends and can help you interpret data. Going in blind is a recipe for emotional overbidding.

Get Pre-Approved, Not Just Pre-QualifiedPre-qualification gives you an estimate, but pre-approval shows sellers you’re serious and ready. A pre-approval letter also gives you a firm upper limit on your budget and helps prevent you from accidentally offering too much. Lenders will assess your credit, debt-to-income ratio, and employment status to determine what you can realistically afford. Use this number as your ceiling, not your target.

Know What the Home Is Really WorthJust because a home is listed at a certain price doesn’t mean it’s worth that amount. Look at comparable properties in the neighborhood. What did similar homes sell for recently? Are there any upgrades or features that justify a premium, or signs the home is overpriced? Pay attention to days on market and price reductions. If a house has been sitting for weeks in a hot market, the asking price may be too high.

Set a Firm Budget (and Stick to It)Before you make any offers, define your absolute maximum and decide under what conditions you’d walk away. Be disciplined, especially in emotionally charged multiple-offer situations. Include room in your budget for closing costs, immediate repairs, and post-move expenses like furniture or landscaping. Your dream home isn’t a dream if it puts you under financial strain.

Make a Smart Offer — Not Just the Highest OneYou can strengthen your offer in ways that don’t involve raising the price. A large earnest deposit, flexible closing date, and limited contingencies can all appeal to sellers. Work with your agent to craft a strong offer that balances competitiveness with financial protection. Sometimes a well-written offer with fewer conditions can beat a higher bid filled with contingencies.

Don’t Skip the Appraisal and InspectionAn appraisal ensures the home is worth what you’re paying. If it comes in low, you can renegotiate, or walk away. A thorough inspection reveals any structural or mechanical issues that could cost you later. Even in hot markets, waiving these protections is risky. If you must waive them to compete, consider doing an informational inspection post-closing or negotiating a shorter inspection window instead.

Control Your Emotions During NegotiationFalling in love with a home can cloud your judgment. Sellers (and even agents) can sense desperation and use it to their advantage. Remind yourself that there will always be another property and that buying the right home at the right price is better than rushing into one you can’t afford. Stay calm, deliberate, and data-driven.

Watch Out for Hidden CostsOverpaying isn’t just about the listing price. Property taxes, HOA fees, utility costs, insurance premiums, and maintenance add up. Research these numbers in advance. A home with a low sale price but high upkeep may ultimately cost more than a slightly more expensive one that’s efficient and low-maintenance.

Don’t Over-Renovate to CompensateIt’s tempting to overpay for a home that “needs work” with the plan to renovate. But major upgrades rarely return 100% of their cost. Make sure you’re not overestimating your ability or budget to transform a home. And don’t justify overpaying by thinking you’ll add value later. In most cases, you’ll only recoup a portion of what you invest.

Have an Exit StrategyBefore you buy, think about resale. Is this home likely to hold or increase in value over time? Are there factors that might make it hard to sell later, like a busy street, poor layout, or odd zoning? If market conditions change and you need to move within a few years, can you rent it out or break even? Buying smart also means planning for the long term.

Your dream home should bring you joy, not financial stress. With discipline, research, and strategic negotiation, you can buy confidently and stay within your means. It’s possible to win in today’s market without sacrificing your financial future. Remember: the goal isn’t just to buy a home, it’s to make a smart investment in your life.

Multiple Offers: How To Pick The Right One Not Just The Highest

Summary

In a hot market, sellers often receive multiple offers. While it’s tempting to choose the highest price, not all offers are created equal. This report helps you evaluate every part of an offer, from financing strength to closing flexibility, to ensure you pick the one that’s most likely to close smoothly and leave you satisfied. Learn how to compare, negotiate, and choose wisely.

Receiving multiple offers can feel like a dream come true, but it can also be overwhelming. Choosing the highest offer might seem obvious, but the smartest sellers look beyond price to evaluate the full picture. A slightly lower offer with better terms can sometimes be the safer, more profitable path. Here’s how to compare and choose offers with confidence.

- Look at Financing Type

- Cash Offers: These typically close faster and have fewer risks (no appraisal or loan approval delays).

- Conventional Loans: Strong, especially with large down payments.

- FHA/VA Loans: May require more stringent appraisals or repairs.

Ask to see a pre-approval letter or proof of funds to confirm the buyer’s financial strength.

- Review the Contingencies

Contingencies give buyers legal outs, but too many create uncertainty for you. Common contingencies include:- Financing: Standard, but risky if the buyer is only marginally qualified.

- Appraisal: May trigger price negotiations if the home appraises low.

- Inspection: Allows buyers to back out or request repairs.

- Home sale: Risky, ties your sale to another closing.

Fewer contingencies equals a stronger, cleaner offer.

- Consider the Closing Timeline

A quick close may be ideal if you’re ready to move. A longer close might be better if you need time to find your next home. Flexibility matters—offers that match your preferred timeline are often more attractive.

- Compare Earnest Money Deposits

Earnest money shows the buyer’s seriousness. Larger deposits reduce your risk. Typical ranges are 1–3% of the offer price.

- Understand Buyer Motivation

Buyers relocating, with deadlines or emotional attachment, may be more committed. Others just “testing the market” may be more likely to walk away.

- Beware of Escalation Clauses

Some buyers include clauses that automatically increase their offer above the highest bid. These can be tricky to navigate. Always confirm the buyer’s price ceiling and review how the clause is structured.

- Check Offer Expiration Dates

Some offers are only good for 24–48 hours. Don’t let a deadline force a rushed decision, but be mindful that delays could cause a buyer to walk away.

- Don't Forget About Personal Letters

While not always effective or appropriate, some buyers submit “love letters” with their offers. These can help humanize a buyer and provide insight into their motivation, though fair housing laws limit what can be considered.

- Ask Your Agent for a Net Sheet

Your agent can provide a side-by-side breakdown showing what you’ll actually walk away with from each offer. This includes price, concessions, and estimated costs. -

Don’t Be Afraid to Counter or Ask Questions

If you like parts of multiple offers, your agent can help you counter or ask for clarifications. You’re not locked in until you sign.

Conclusion:

Getting multiple offers is a good problem, but it’s still a problem to solve. Look beyond just price and evaluate the full offer package: financing, contingencies, flexibility, and likelihood of closing. The best offer is the one that gets you to the finish line with the fewest headaches and the most money in your pocket.

Winter Haven, FL Home For Sale

|

Get a Cash Offer in 48 Hours — Sell Your Central Florida Home Fast! Get a Cash Offer in 48 Hours — Sell Your Central Florida Home Fast!

|

Attention Central Florida Home Buyers!Attention Central Florida Home Buyers! Come and see this Awesome home owned by an Executive Chef with Disney. This home comes equipped with a back yard with many of the fresh Fruits, Vegetables, and Spices to Cook like an experienced Chef to feed your family and keep them healthy. This Open Floor plan home is laid out perfectly for a family to enjoy their time together.

|

Awesome Central Florida Home located in a quiet community near many of the Amazing Parks & Beautiful BeachesCome see this Awesome Central Florida Home located in a quiet community near many of the Amazing Parks & Beautiful Beaches, people come to Florida to see. Whether you're looking for a full time residence, a vacation getaway, or a rental, this Home checks off every box. Call us NOW to schedule a showing and get the updated price at 863-602-5944.

|

Central Florida Real Estate Market Update: Late Summer 2025 Brings Strategic OpportunitiesAs we move through the late summer months of 2025, Central Florida's real estate market continues to evolve in ways that present unique opportunities for buyers, sellers, and investors alike. After months of rapid changes in interest rates, inventory levels, and pricing trends, we're finally seeing some stability emerge—and the timing couldn't be better for those ready to make their move. Central Florida's real estate landscape in August 2025 presents a compelling narrative of balance and opportunity. Here's what the latest data reveals: These numbers paint a picture of a market that's finding its equilibrium after the volatility of recent years. Unlike the rapid appreciation we saw in 2021-2022 or the uncertainty that marked 2023-2024, we're now experiencing what many economists call a "normalized" market environment. If you've been waiting on the sidelines, late summer 2025 might be your moment to act. Here's why: Improved Inventory Levels: With 2.1 months of inventory available, buyers have significantly more options than they did even six months ago. This translates to: Interest Rate Stabilization: While 6.8% isn't the ultra-low rates of 2020-2021, the stabilization means you can plan with confidence. Lenders are reporting more predictable approval processes, and buyers can budget without worrying about rates jumping unexpectedly during their search. Strategic Timing: Late summer traditionally sees motivated sellers—families looking to move before the school year, empty nesters ready to downsize, and investors adjusting their portfolios. This creates opportunities for savvy buyers who are prepared to move quickly on the right property. Don't let talk of a "buyer's market" discourage you—quality properties are still commanding strong prices and selling efficiently. Here's what successful sellers are doing: Pricing Strategy Matters More Than Ever: With more inventory available, overpriced homes sit while appropriately priced properties receive multiple offers. Work with an agent who understands hyperlocal pricing trends in your specific Central Florida community. Presentation is Everything: Staging, professional photography, and strategic marketing have become non-negotiables. Homes that show well online and in person are still selling within the first two weeks. Flexibility Creates Value: Sellers who can accommodate buyer preferences on closing dates, allow time for inspections, and consider reasonable requests are closing deals faster and often at higher prices. Central Florida continues to attract investors for solid fundamental reasons that haven't changed: Population Growth: The region continues to see net positive migration, with an estimated 1,000 new residents moving to Central Florida weekly. Employment Expansion: Major employers including Disney, Universal, Lockheed Martin, and numerous tech companies continue expanding their Central Florida footprint. Tourism Recovery: Visitor numbers have returned to pre-pandemic levels, supporting short-term rental markets throughout the region. Downtown Orlando and surrounding neighborhoods are experiencing a renaissance, with new mixed-use developments and improved infrastructure driving demand. Condos and townhomes near the city center are particularly popular with young professionals and empty nesters. Properties within 15 miles of Disney World and Universal Studios remain investment goldmines. Vacation rental properties are showing occupancy rates of 85% or higher, with average daily rates recovering to 2019 levels plus inflation adjustments. Luxury markets in these prestigious communities continue to thrive. Waterfront properties are seeing 20% more showing activity than last month, with buyers drawn to the combination of excellent schools, cultural amenities, and prime location. New construction in these rapidly growing communities offers modern amenities and competitive pricing. Builders are offering incentives including rate buy-downs and upgraded finishes to attract buyers. The area around the University of Central Florida remains an investor favorite, with rental demand consistently exceeding supply. Student housing and young professional rentals both show strong performance metrics. Central Florida's unemployment rate of 3.2% remains well below the national average. Key employment sectors showing growth include: Ongoing and planned infrastructure improvements continue to enhance Central Florida's appeal: The region's population growth includes a healthy mix of: Property insurance remains a significant consideration for Central Florida buyers. However, new construction with hurricane-resistant features and homes with updated roofing, windows, and systems can qualify for substantial discounts. August through November remains hurricane season. Buyers should prioritize homes with: Many Central Florida communities include HOA fees that cover amenities like pools, fitness centers, and landscaping. While these add to monthly costs, they often enhance property values and quality of life. Based on current trends and historical patterns, here's what we anticipate for the fall 2025 market: The Central Florida market continues to embrace technology that benefits both buyers and sellers: Many listings now offer VR experiences, allowing out-of-state buyers to "walk through" properties before visiting in person. Advanced algorithms provide more accurate pricing guidance, helping both buyers and sellers make informed decisions. From offer submission to closing, digital tools are streamlining the buying and selling process, reducing timelines and improving communication. Central Florida's late summer 2025 real estate market presents the best balance of opportunity and stability we've seen in several years. Whether you're a first-time homebuyer, a growing family looking to upgrade, an empty nester ready to downsize, or an investor seeking strong returns, the current market conditions create strategic opportunities for those ready to act. The key to success in today's market is working with experienced local professionals who understand both the numbers and the nuances of Central Florida's diverse communities. With proper guidance, realistic expectations, and good preparation, buyers and sellers can navigate this market successfully and achieve their real estate goals. The Central Florida real estate market waits for no one, and the current conditions won't last forever. If you're considering buying, selling, or investing in Central Florida real estate, now is the time to start the conversation.

|

Russ Yerton, Recognized by BestAgents.us as a 2025 Top AgentRuss Yerton, Recognized by BestAgents.us as a 2025 Top Agent

Combining Automotive Expertise with Real Estate Passion, Russ Yerton Delivers Exceptional Results for his Clients The Yerton Home Team, a part of Elevate Real Estate Brokers, is setting new standards in Lakeland and the surrounding Central Florida Real Estate market with his unique blend of automotive industry experience and a Client-Centered approach to real estate transactions. With marketing for the SELLERS like, YOUR HOME SOLD, GUARANTEED, OR WE’LL BUY IT!”, and “COME SEE THIS AWESOME HOME FOR SALE OR TRADE”, (he said, why not, we did it in the automobile business) and the BUYERS we serve get OUR GUARANTEE that “If you’re not 100% satisfied with the Home we help you buy, even up to 2 Years after closing, We’ll Buy It Back, or Sell it, Free.” (Stress reversal) Here are the results we have been able to help others, like you, achieve this past year… and why! We love to watch God bless the people He has us serve. Being born here in Central Florida, Russ Graduated from USF with a Business and finance degree, then worked as a Business Manager, and consultant for automobile dealerships for about 5 years before managing some of the largest Toyota Dealerships in the Southeast for about 7 years. He then, to be able to spend more time with his growing family, returned to his hometown to work with his Father and Brothers in their family-owned automotive dealership, Yerton Leasing and Auto Sales, for almost 30 years. Russ brings a wealth of knowledge and negotiation skills to the table, ensuring a smooth and successful experience for buyers and sellers alike. He says, I am blessed when both sides of a transaction are very happy with the sale results, I love Win…Wins. Russ’s deep roots in Central Florida enable him to provide invaluable insights into the local market, helping clients navigate the complexities of buying and selling homes. His passion for real estate was sparked by his experience in designing and building several homes, and he is now dedicated to empowering families throughout Central Florida to make informed decisions about their real estate investments. “My goal is to educate my clients so they feel confident and comfortable throughout the process,” says Yerton. “I believe that informed clients are the happiest clients.” As the leader of Central Florida Home Deals / The Yerton Home Team, Russ stands by his commitment to delivering extraordinary results. He offers UNIQUE GUARANTEES FOR SELLERS AND BUYERS, as he mentioned above, which sets him apart in the competitive real estate landscape. This approach not only underscores his confidence in God’s ability to deliver but also reflects his dedication to his client satisfaction and a less stressful transaction. Beyond his professional life, Russ is a devoted family man, married to his wife Lisa for over 40 years, and together they have raised their three children, who all still live here in Central Florida with their spouses, and now enjoy being just minutes away from their new granddaughter. Russ has been actively involved on the Leadership Board of West Central Florida Fellowship of Christian Athletes (FCA) for over 35 years, working in and through the Coaches and Athletes by supporting educational initiatives for the Coaches to not only coach physically but also emotionally and spiritually. FCA has been making a difference for over 70 years here in America, and now, in over 100 countries around the world. Locally, our schools from elementary through college levels have been impacted by 3D coaching and teaching. Our business has had the honor and pleasure of donating a portion of our income from every transaction to FCA, and The Wingman Men’s ministry, where Russ was honored to serve on the Leadership Board for 12 years. There we mentored men to be “Men after God’s own Heart, Better Husbands, and Better Dads”, and their wives and children loved it. Also, we love to help the “One More Child organization, which since 1904 has supported families in need with meals, (19 million last year), helping Foster Children receive parents, rescuing trafficked children, helping single moms and families, and getting support/sponsors for children around the world. These three Worthy Causes are making an Eternal difference in many lives. Russ’s commitment to service extends beyond real estate, showcasing his desire to positively impact his community and the world. Russ attributes his success to God, who enables him to “Not try to sell folks something, but instead, help them get what they want.” To God be the Glory, for all the things we get to experience Him doing. With unwavering faith, honesty, and integrity, combined with a genuine passion for helping others achieve their real estate goals, The Yerton Team continues to thrive, remaining focused on exceeding client expectations and fostering lasting relationships built on trust and transparency.

|

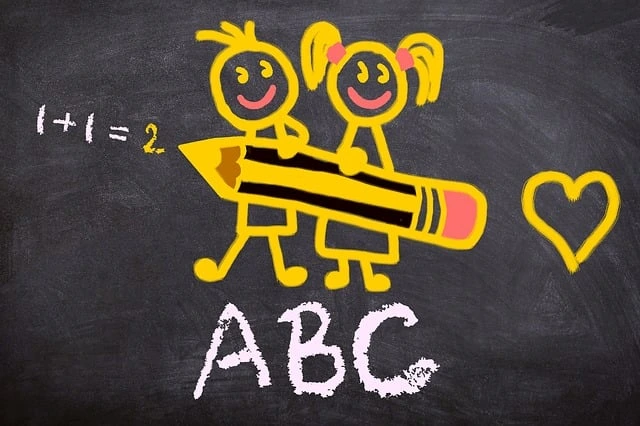

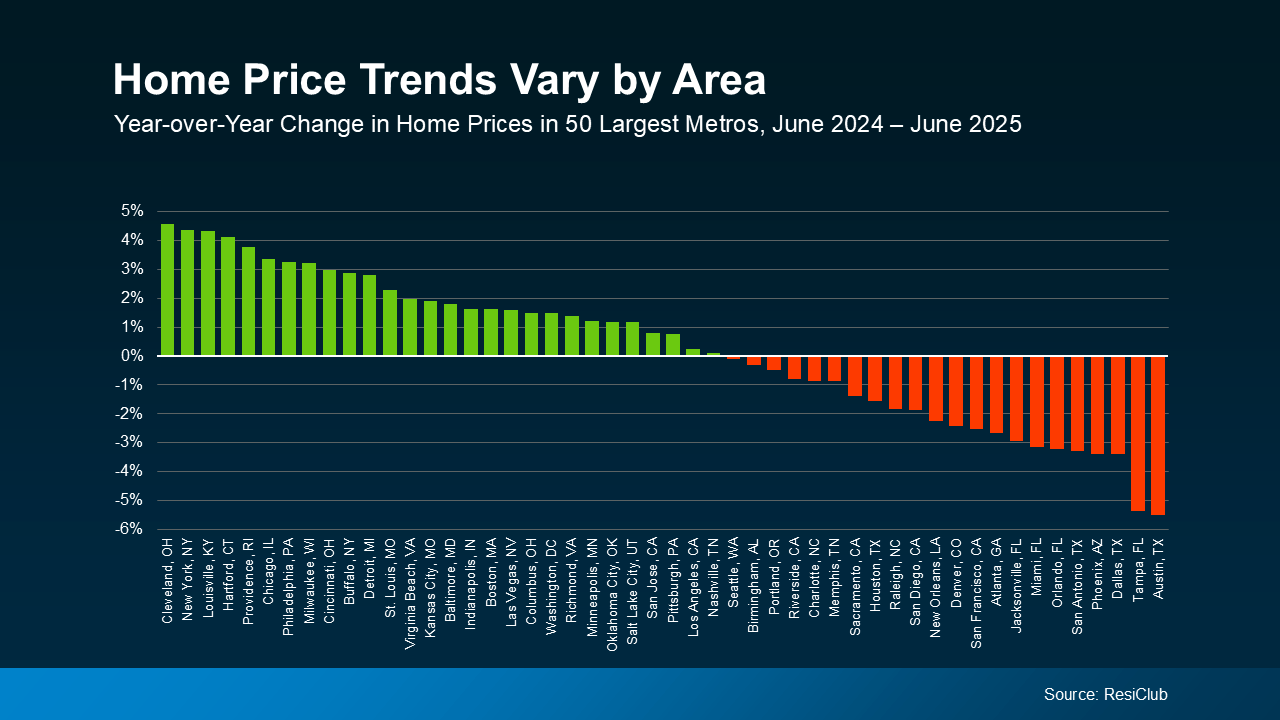

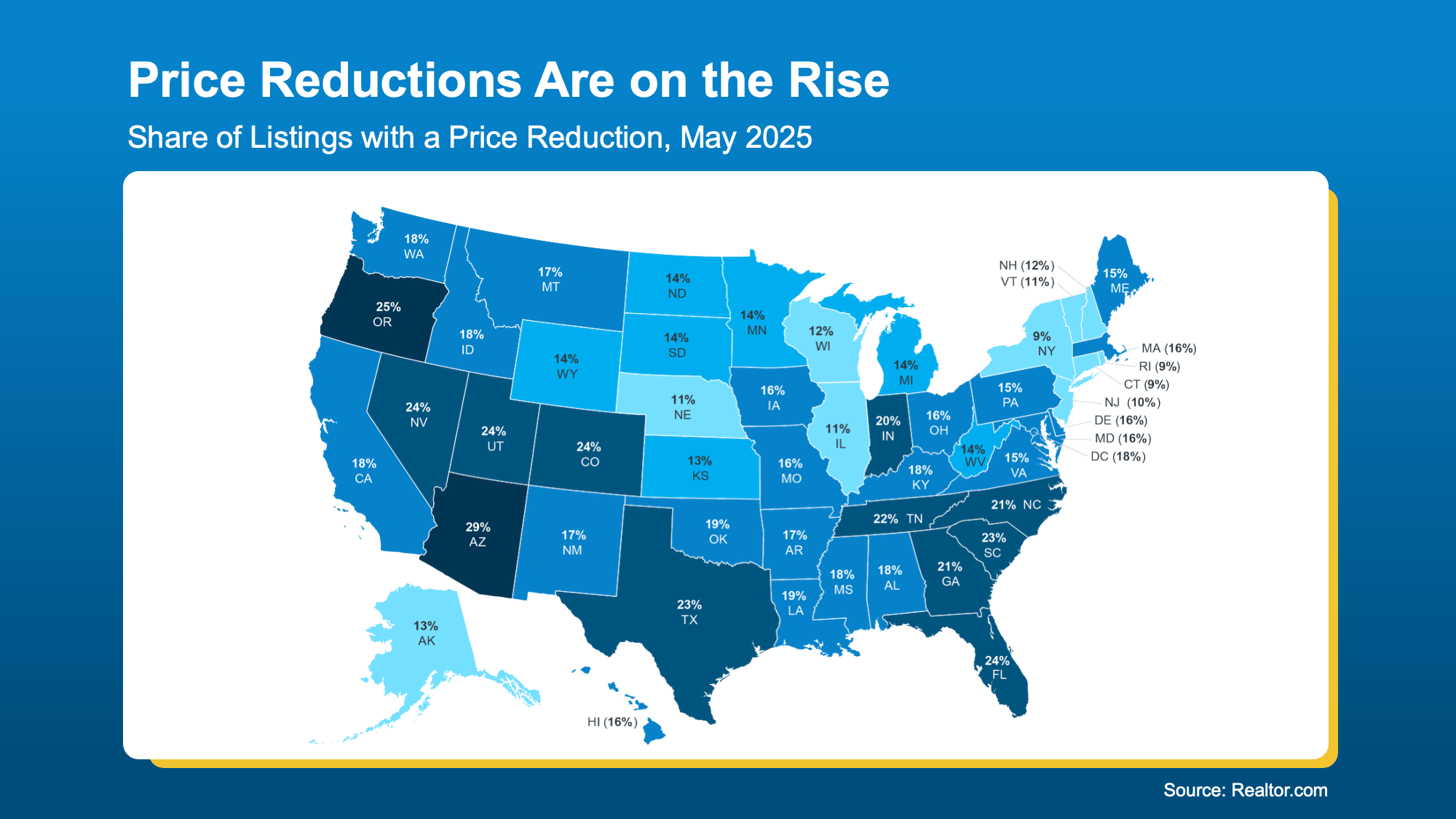

The 3 Things You Risk by Pricing Too HighWhen selling your house, the price you choose isn’t just a number, it's a strategy. And in today’s market, that strategy needs to be sharp. The number of homes for sale is climbing. And that means buyers have more choices and can be more selective. If your price doesn’t line up with what else is out there, they’ll scroll right past it and go on to the next one. Pricing right from the start is your best move – and a great agent can help make sure you do. And more sellers are finding that out the hard way. They list their house based on how things were a year ago – or based on a neighbor’s sale that happened under completely different circumstances. Then, when their house doesn’t sell, they’re left with three tough choices: None of those options were part of the original plan. And honestly, none of them are where you should end up if you wanted to sell. Here’s a look at how a local agent’s expertise can help you avoid these headaches. Let's use price cuts as an example. While the number of price cuts is up nationally, data shows some parts of the country are seeing far more of them than others. It all comes down to how much inventory has grown in that area (see map below): That means pricing isn’t one-size-fits-all. What’s happening nationally might not reflect what’s happening in your zip code, and that’s why you shouldn’t try to determine your list price on your own. A skilled agent doesn’t just toss out a number. As Zillow says: And that’s all knowledge your agent will have. They study your local market, compare recent sales, and factor in your goals and buyer behavior. Based on what’s happening where you live, sometimes the best play will be pricing right at current market value. Other times pricing a little lower actually will spark more offers and ultimately get you a better final sale price. So don’t skimp on the strategy or on your agent. With their local market know-how, you’ll be able to sell quickly, even in a shifting market. Overpricing can lead to tough choices you never want to face. But with the right price, and the right guidance, you can skip the stress and sell with confidence. Let’s connect so you have a pricing strategy that works for today’s market and gets you where you want to go.

|

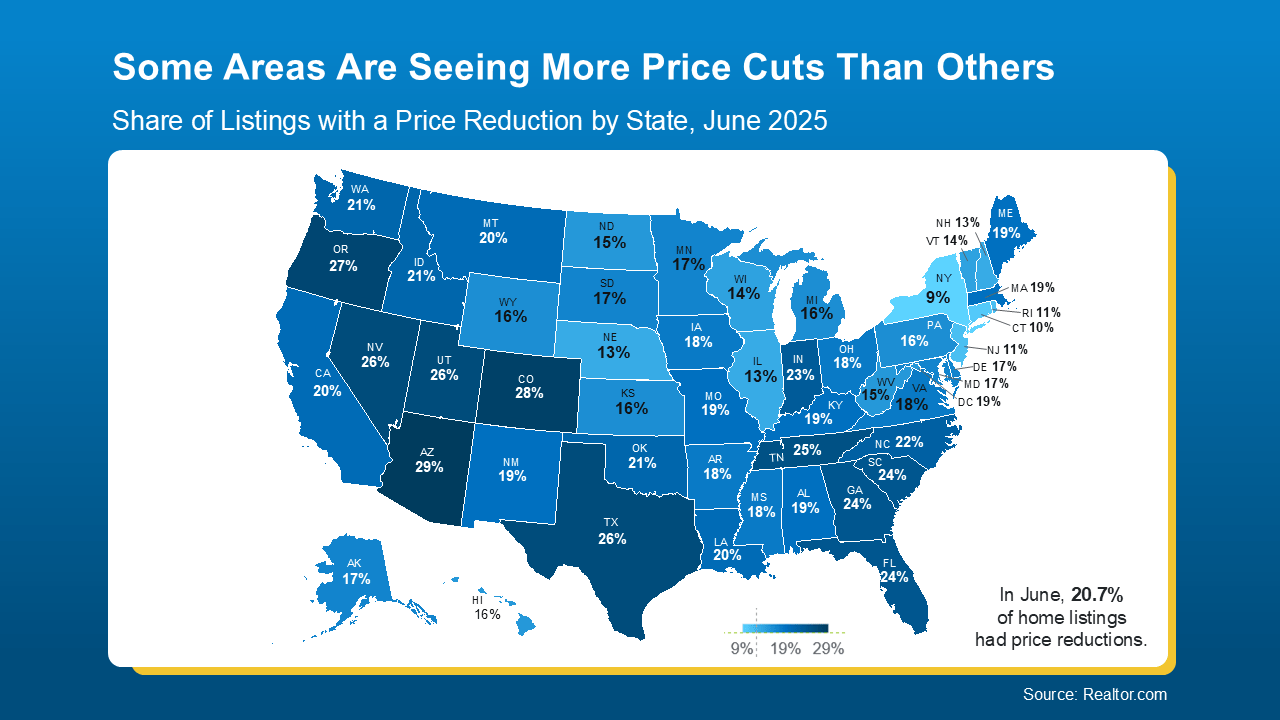

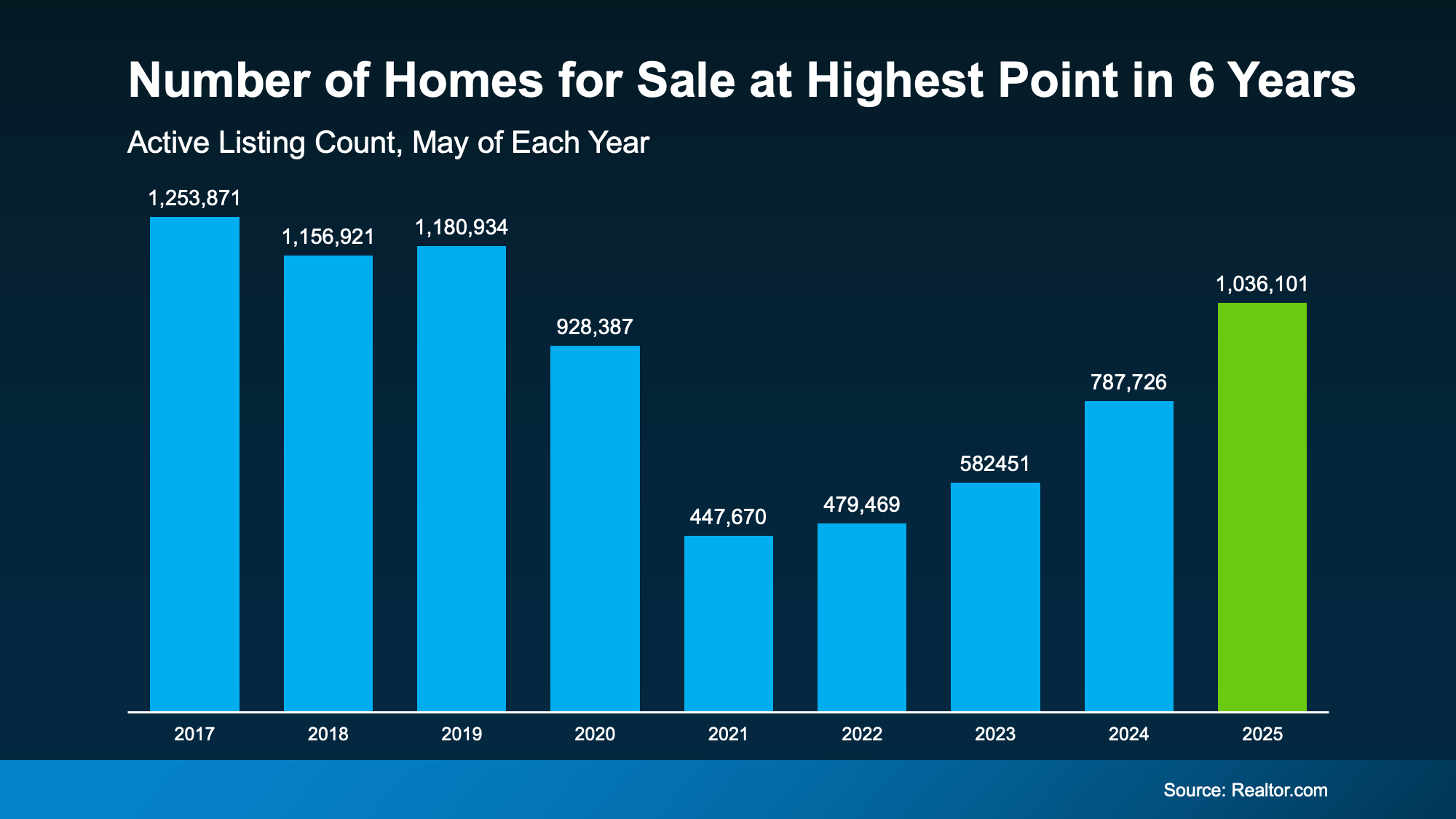

Today’s Tale of Two Housing MarketsDepending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in different directions. In some places, buyers are calling the shots. In others, sellers still hold the power. It’s a tale of two markets. In a buyer’s market, there are more homes for sale and not as many buyers. That means homes sit longer, buyers have more negotiating power, and prices tend to soften as a result. It’s simple supply and demand. On the flip side, a seller’s market happens when there aren’t enough homes available for the number of people looking to buy them. Because buyers have to compete with each other to get the house they want, that leads to faster sales, multiple offers, and rising prices. Right now, both of these scenarios are playing out, depending on where you are. So, how do you know what kind of market you’re in? Lean on a local real estate agent. They’ll explain what’s really happening in your area based on these key drivers. One of the biggest factors impacting each market is the number of active buyers and sellers. According to Redfin, here’s what that looks like by region (see graph below): But the South and West are leaning more toward buyer’s markets. There are more sellers than buyers, which means more listings to choose from and less competition among buyers. That’s a major shift from a few years ago when sellers had the advantage almost everywhere. Today, your local conditions matter more than ever – and they can vary even from one neighborhood to the next. When inventory and buyer activity shift, so do prices. In places where demand still outpaces supply, like much of the Northeast and Midwest, prices are continuing to climb. But in parts of the South and West where inventory is up and demand has cooled, prices are softening. And that’s a plus for buyers looking to negotiate in those areas. Here’s the latest price data from ResiClub to show how this divide is shaking out across the top metros in the country (see graph below): That said, don’t panic if you own a home in a market where prices are dipping. Most homeowners have built up significant equity over the past few years, and chances are you have too. So, you’re likely still come out way ahead when you sell. Even in regions that lean more buyer-friendly right now, there will be cities, towns, and even neighborhoods that don’t follow the regional trends. That’s why an agent’s local market expertise is so important. They can help you understand what’s happening all the way down to a zip code level, including: In a market where conditions vary this much from place to place, success starts with understanding every aspect of your local area. Let’s connect so you’ve got an expert in your corner who knows exactly how to guide you through your market, wherever you are.

|

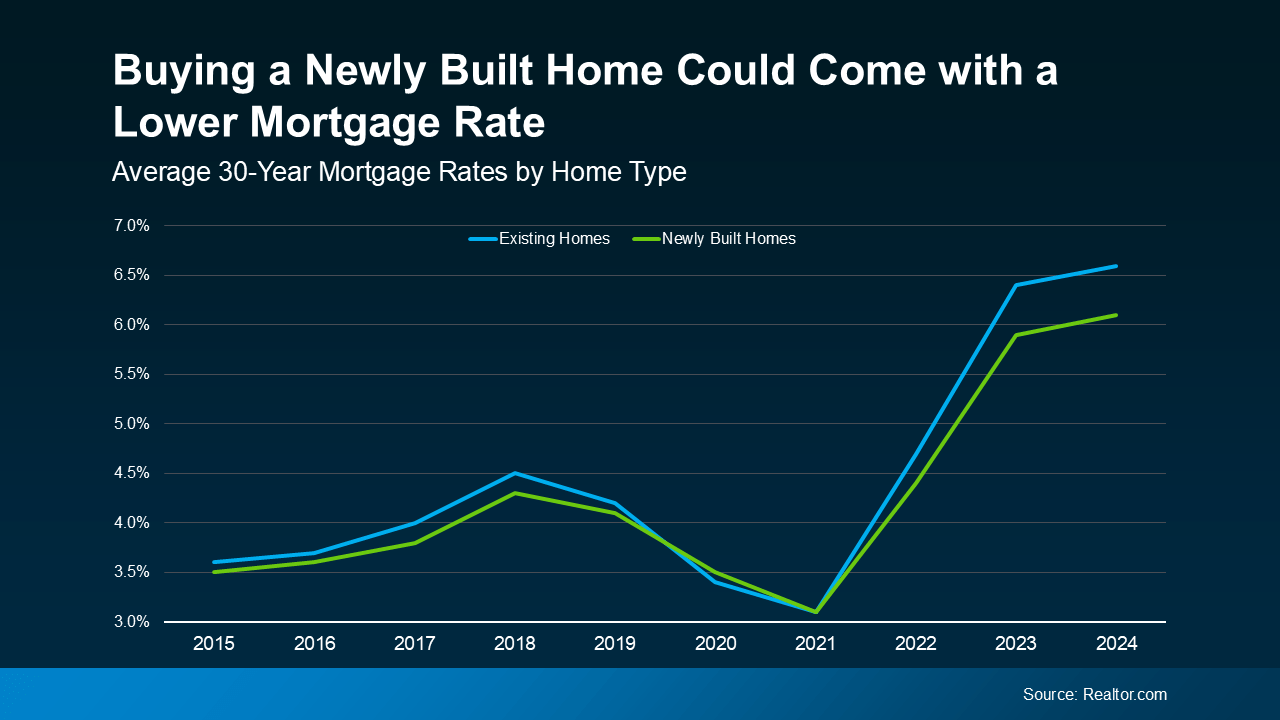

Why a Newly Built Home Might Be the Move Right NowThere are more brand-new homes available right now than there were even just a few months ago. According to the most recent data from the Census and the National Association of Realtors (NAR), roughly 1 in 5 homes for sale right now is new construction. So, if you’re not looking at newly built homes, you’re missing out on a big portion of what’s available. And with more new homes on the market, builders are motivated to sell their current inventory. As a result, many are taking steps to draw in buyers. According to Buddy Hughes, Chairman of the National Association of Home Builders (NAHB): That means builders are being realistic about today’s market and adjusting to what buyers can afford. It’s their way to keep their inventory moving. So, builders may be more willing to negotiate price than you’d expect – and that means your dollar may go further if you buy a newly built home. Lean on your agent to see what’s available and what incentives builders are offering in and around your area. Here’s something most people don’t know. Right now, buyers of brand-new homes often get better mortgage rates than buyers of existing homes. That’s because many builders are also offering rate buydowns to make their homes more attractive and keep sales moving. Basically, they’re willing to chip in to lower your rate, so you’re more likely to buy one of their homes. Data from Realtor.com shows, in 2023 and 2024, buyers of newly built homes got a mortgage rate around half a percent lower compared to those who bought existing homes (see graph below): So, if you haven’t found something you love yet, it’s time to add newly built homes to your search. You may find that what you’ve been looking for is already out there, it’s just in a new home community. More choices, the potential to negotiate on the price, and maybe even better mortgage rates make these options a bright spot in today’s housing market. If you haven’t considered a newly built home yet, what’s holding you back? Let’s talk about it and see if it’s worth checking out new builds in and around our area.

|

Your Florida Dream Home Awaits – Resort Living in Central Florida

|

Multi-Generational Homebuying Hit a Record High – Here’s WhyMulti-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below): In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise. With today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources. By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains: But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains: And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home. Maybe it’s a solution that would make sense for you too. The best way to find out? Talk to a local real estate agent who can help you decide if this option would work for you. If your budget feels tight, buying a multi-generational home could be a smart solution. Would you ever consider buying a home with a family member? Why or why not? Let’s connect to talk through your options.

|

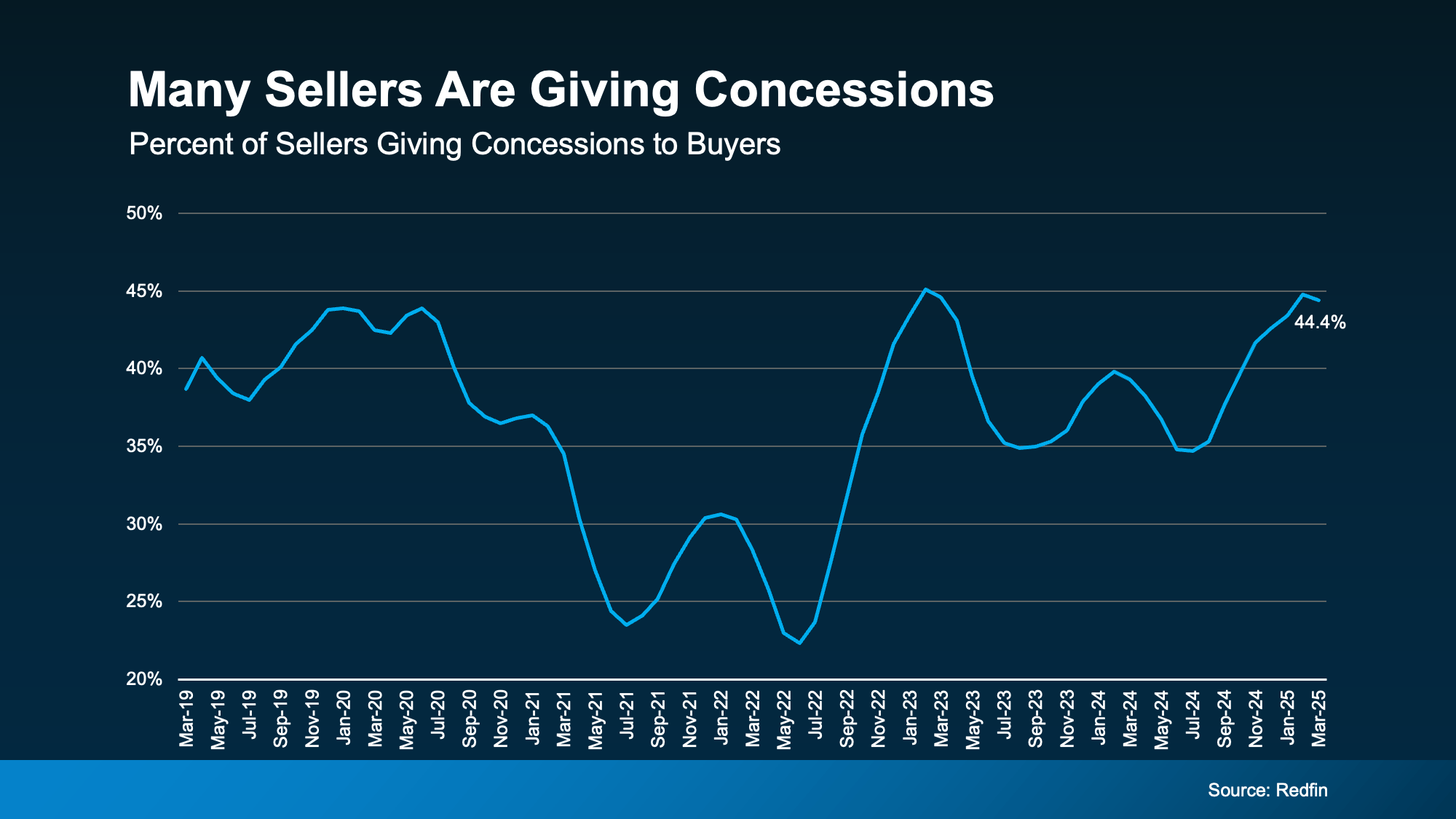

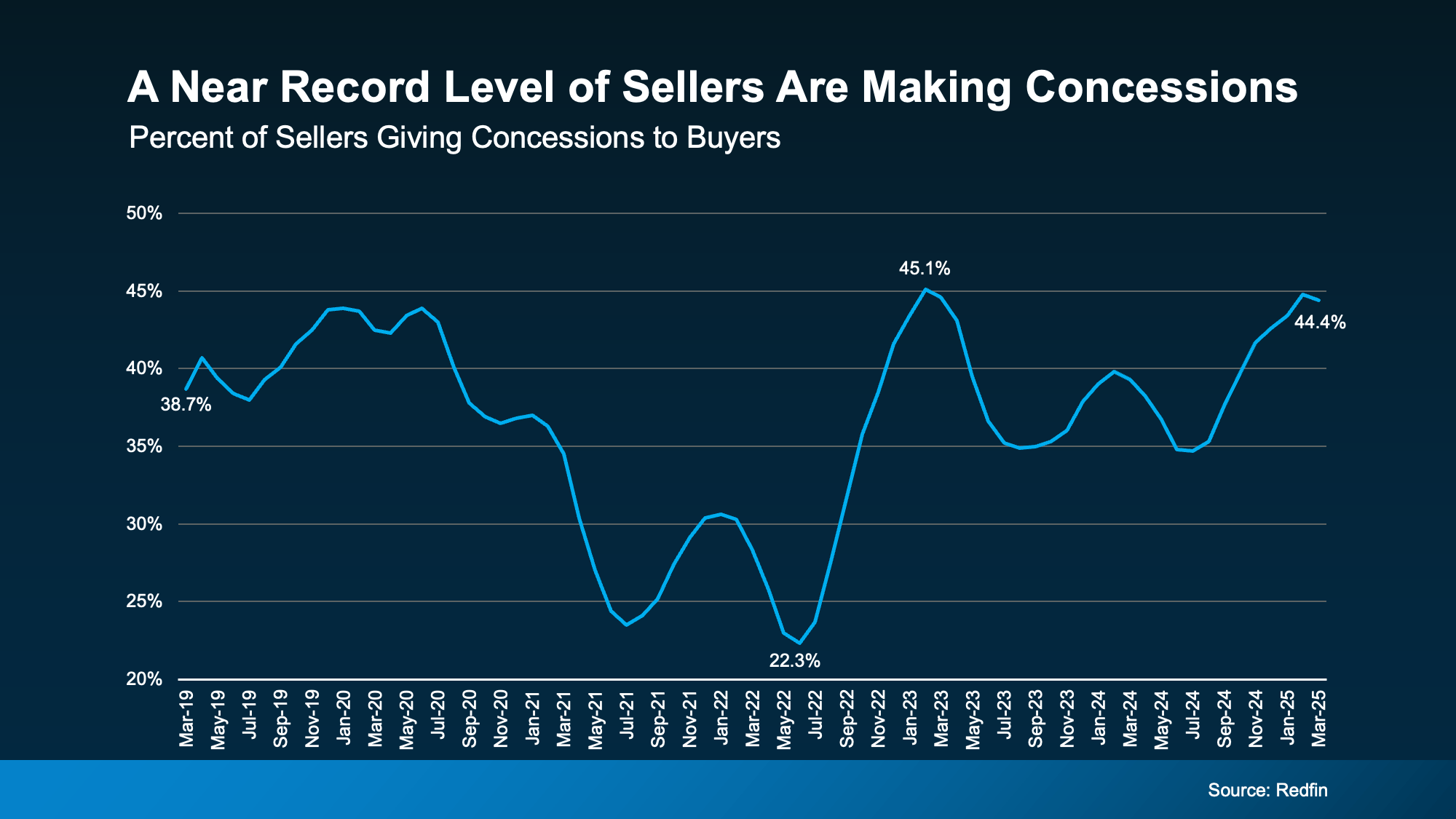

What Every Homeowner Needs To Know In Today’s Shifting MarketHere’s something you need to know. The housing market is getting back to a healthier, more normal place. And even though it may not sound like it, this shift is actually a good thing. It’s what you should expect. It’s just that our expectations have been skewed by the intense seller’s market over the past few years. But what you need to remember is: there’s still plenty of opportunity to be had if you’re thinking about selling – whether that’s next month or next year. You just need to stay up to date on what’s happening in the market, and have a strategy that matches the moment. Here's your update. According to the latest data, the number of homes for sale is rising back toward more normal levels (see graph below): If you’re in a market where the number of homes for sale is back to normal, buyers may have more sway than you’d expect. That doesn’t mean buyers have all the power – it just means they have more choices, so your home has to stand out. But if you live where inventory is still pretty limited, you may see more buyers competing for your house. No matter where you are, the key is to work with a pro who can help you adjust your game plan for your local market. With more homes to choose from, today’s buyers are quick to skip over homes that feel overpriced. That’s why pricing your house right is the secret to selling quickly and for top dollar. That’s a point Realtor.com really drives home: Miss the mark, though, and you may have to backtrack. Today, about 1 in 5 sellers (19.1%) are reducing their asking price to attract buyers (see map below): The best way to get that information? Lean on your local agent. They have the expertise to set a price that sells in any market. Because if your price isn’t compelling, it’s not selling. Gone are the days of buyers waiving inspections and appraisals just to get a deal done. Now, because they have more homes to choose from, buyers are able to ask for things like repairs, credits, and help with closing costs. And data from Redfin shows nearly 44.4% of sellers are willing to negotiate (see graph below): And it’ll help if you think of concessions as tools, not losses. Use them to bridge gaps, sweeten deals, and get across the finish line. And don’t stress. Since prices went up roughly 55% over the past five years, you’ve got plenty of room to make a concession or two and still come out ahead. Just be sure to work with your agent to understand which concessions could be the key to sealing the deal. Sellers who are going to succeed in the weeks and months ahead are the ones who understand this market shift and lean into it with the right expectations and the right strategy. Let’s talk about what’s working in our local area right now – and how we can make those wins work for you whenever you’re ready to make a move.

|

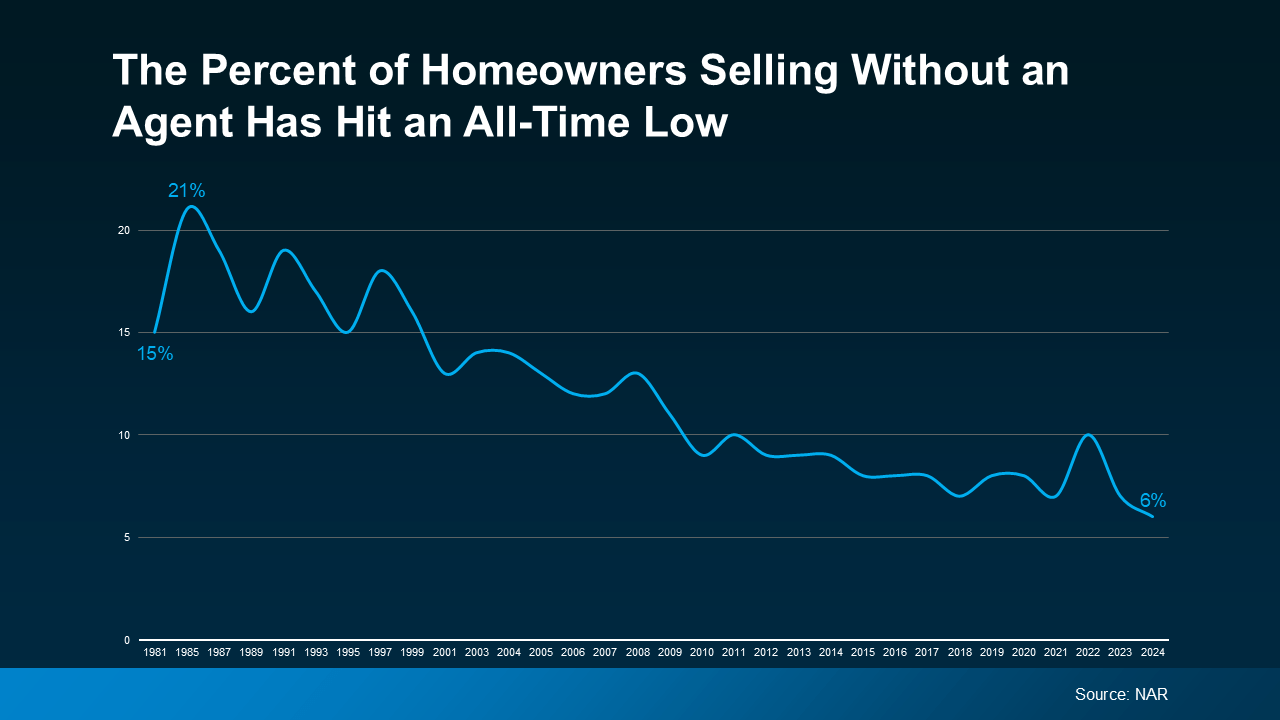

Why Most Sellers Hire Real Estate Agents TodaySelling your house without an agent as a “For Sale by Owner” (FSBO) may be something you’ve considered. But you should know that, in today’s shifting market, more homeowners are deciding that’s just not worth the risk. According to the latest data from the National Association of Realtors (NAR), the number of homeowners selling without an agent has hit an all-time low (see graph below): A recent survey finds three out of every four homeowners who don’t plan to use an agent have doubts about whether that’s actually the right decision. And here’s why. The market is changing – not in a bad way, just in a way that requires a smarter, more strategic approach. And having a real estate expert in your corner really pays off. Here are just two of the ways an agent's expertise makes a difference. One of the biggest hurdles when selling a house on your own is figuring out the right price. It’s not as simple as picking a number that sounds good or selling your house for what your neighbor’s sold for a few years back – you need to hit the bullseye for where the market is right now. Without an agent’s help, you’re more likely to miss the mark. As Zillow explains: Basically, they know what’s really selling, what buyers are willing to pay in your area, and how to position your house to sell quickly. That kind of insight can have a big impact, especially in a market that’s balancing out. There’s also a mountain of documentation when selling a house, including everything from disclosures to contracts. And a mistake can have big legal implications. This is another area where having an agent can help. They’ve handled these documents countless times and know exactly what’s needed to keep everything on track, so you avoid delays. And now that buyers are including more contingencies again and asking for concessions, your agent will guide you through each form step by step, making sure it’s done right and documented correctly the first time. Now that the number of homes for sale has grown, homes aren’t selling at quite the same pace they were. But you can still sell quickly if you have a proven plan to help your house stand out. Just remember, homeowners don’t have the same network or marketing tools an experienced agent does. So, if you want the process to happen fast, you’ll likely want a pro by your side. Having the right agent and the right strategy is key in a shifting market. Let’s connect so you don’t have to take this on solo – and so you can list with confidence, knowing you’ve got expert guidance from day one.

|

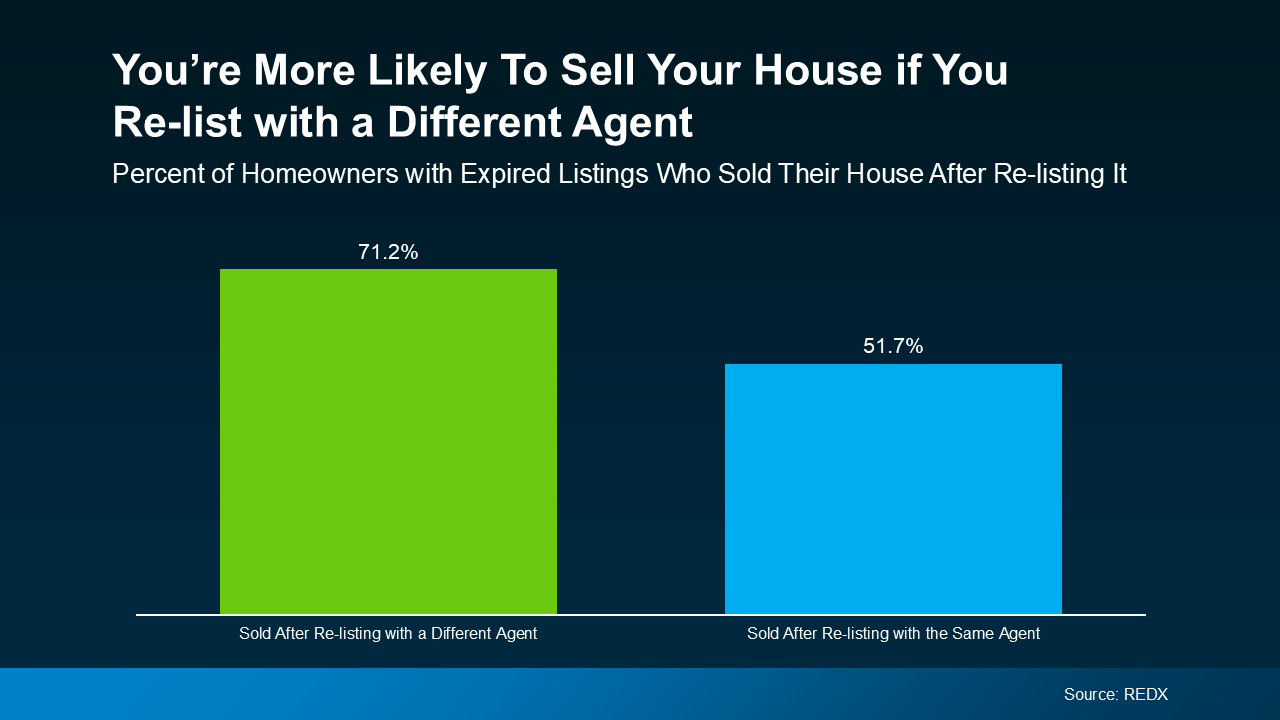

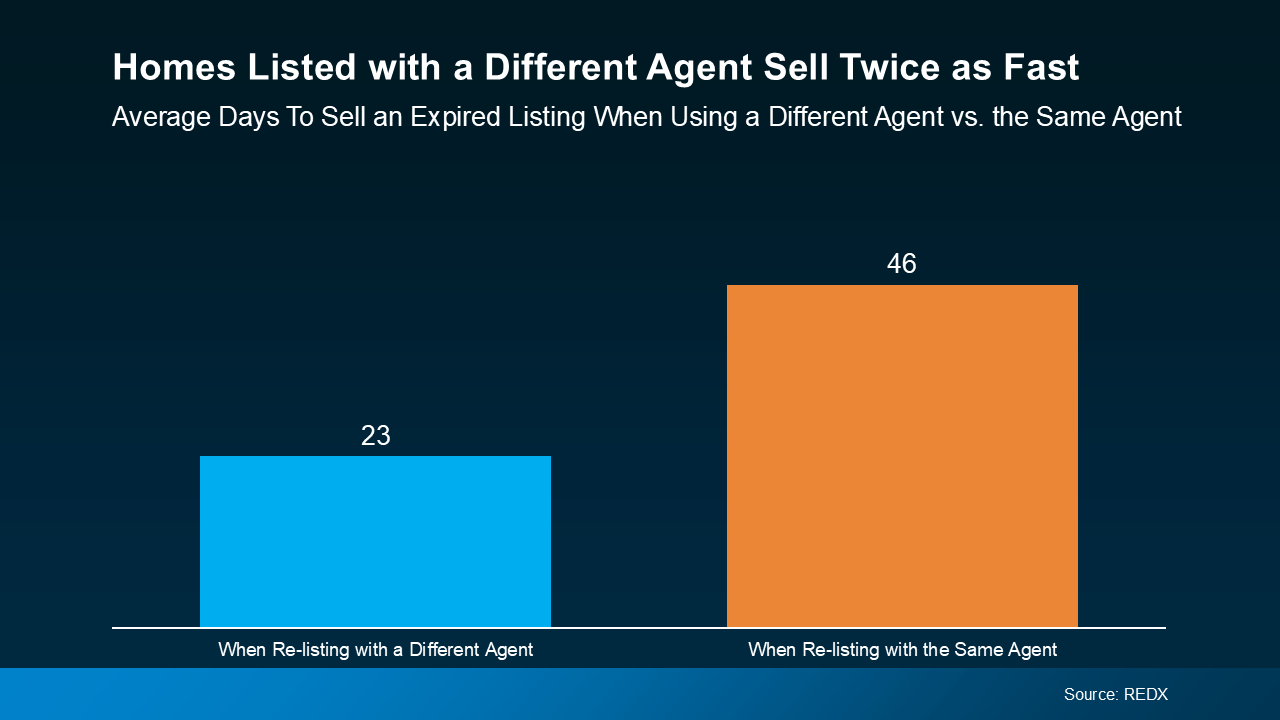

Your House Didn’t Sell. Here’s What To Do Now.When your house doesn’t sell, it doesn’t just feel frustrating – it feels personal. You put time, money, and emotional energy into this move. You told your friends and family it was happening. And now that your listing has expired without a buyer? You’re left feeling stuck, and maybe even a little embarrassed. And here's what most agents won’t tell you. Over 70% of homeowners who re-list with a different agent sell their house. Re-list with the same agent? That stat drops to only 50%, according to the latest data from REDX. That’s like leaving the fate of your sale to a coin toss. And that’s not good enough. Same house. Different strategy. Completely different results. Let's break down what might’ve gone wrong – and how a fresh perspective can help you have a winning strategy this time. Today, homebuyers are feeling the squeeze of higher mortgage rates, so even a slightly overpriced home will get overlooked. And once your listing starts to go stale, it’s hard to regain momentum. Missing the mark on pricing is a costly mistake – and too many homeowners are doing that very thing right now. What we need to do now: We need to analyze the latest sales in your area to make sure you’re hitting the right number. This includes taking a hard look at real-time buyer behavior, and any feedback you got from open houses or showings your first time around. Pricing at, or even just below, current market value is a winning play because it drives more buyers to your listing – and that amps up the competition for your home. You only get one shot at a first impression. If the listing photos didn’t pop, the house wasn’t staged well, or it wasn't updated, most buyers will skip over it without ever scheduling a showing. And even if buyers did show up, small things like scuffed walls, outdated light fixtures, or a wobbly doorknob can turn them away. What we need to do now: Let’s walk through your house with fresh eyes to see if there are any areas that may have been sticking points inside and out. Sometimes taking down old drapery, some light staging, or even a fresh coat of paint can completely change how a buyer feels about the home. If your home didn’t sell, chances are it wasn’t getting the visibility it deserved. Generic flyers and a few online photos aren’t enough anymore. Today’s top agents are using highly targeted digital marketing, social media strategies, custom video content, and more to get your listing in front of the right buyers at the right time. What we need to do now: We have to do more than just put your house online and hope it sells. Together, we can come up with a real plan to maximize its exposure. With the right pricing, staging, and marketing, your house will sell quickly. Here’s a real-world example (see graph below): In this market, sellers who aren’t open to negotiating on things like closing costs, inspection repairs, or other concessions are often left behind. And if your last agent didn’t set that expectation with you, that's a real shame. What we need to do now: Be willing to meet buyers where they are. The goal is to get the deal done – and sometimes that means getting creative to help buyers cross the finish line. Home values have increased by over 55% over the last five years, so you likely have enough wiggle room to offer some perks without sacrificing your bottom line. If your house didn’t sell and your listing has expired, you don’t need to give up. You just need a better plan. And a better partner. Over 70% of homeowners who switch agents sell their house after re-listing it. That’s not a coincidence. That’s strategy. If you're ready for a proven approach, let’s talk so you know what to do differently – and why doing different things actually works. It’s time to get your move back on track.

|

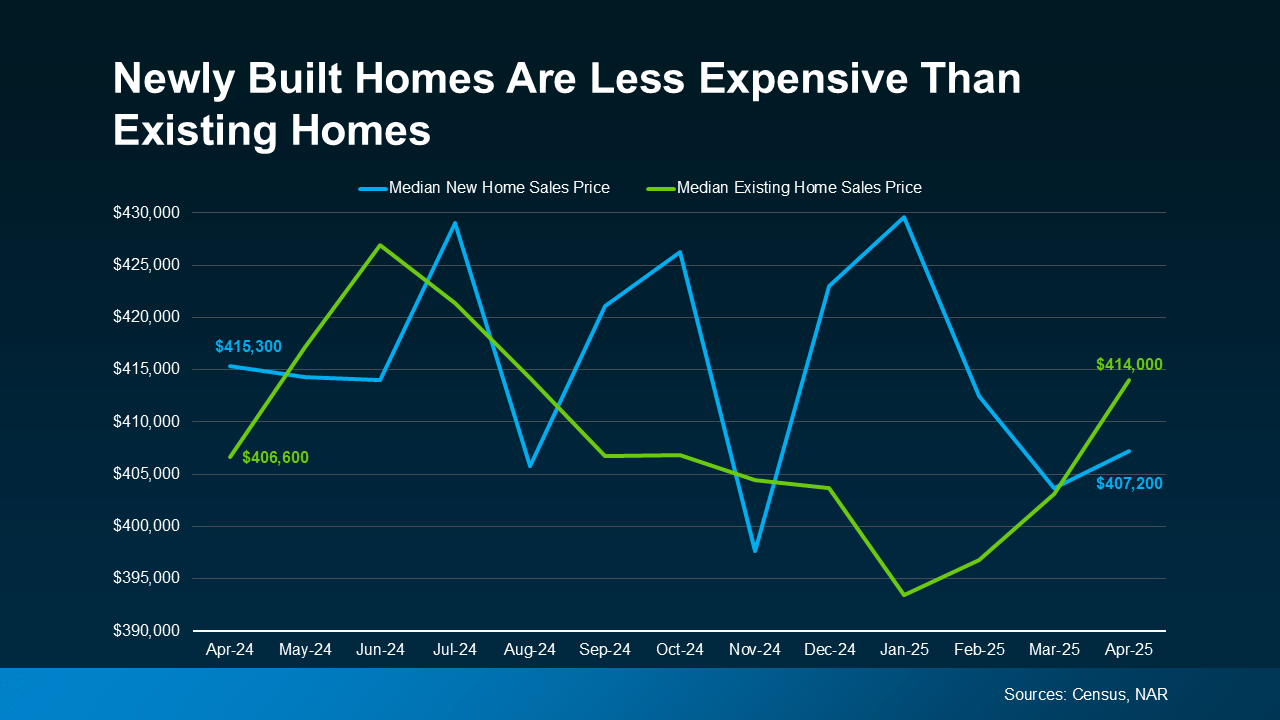

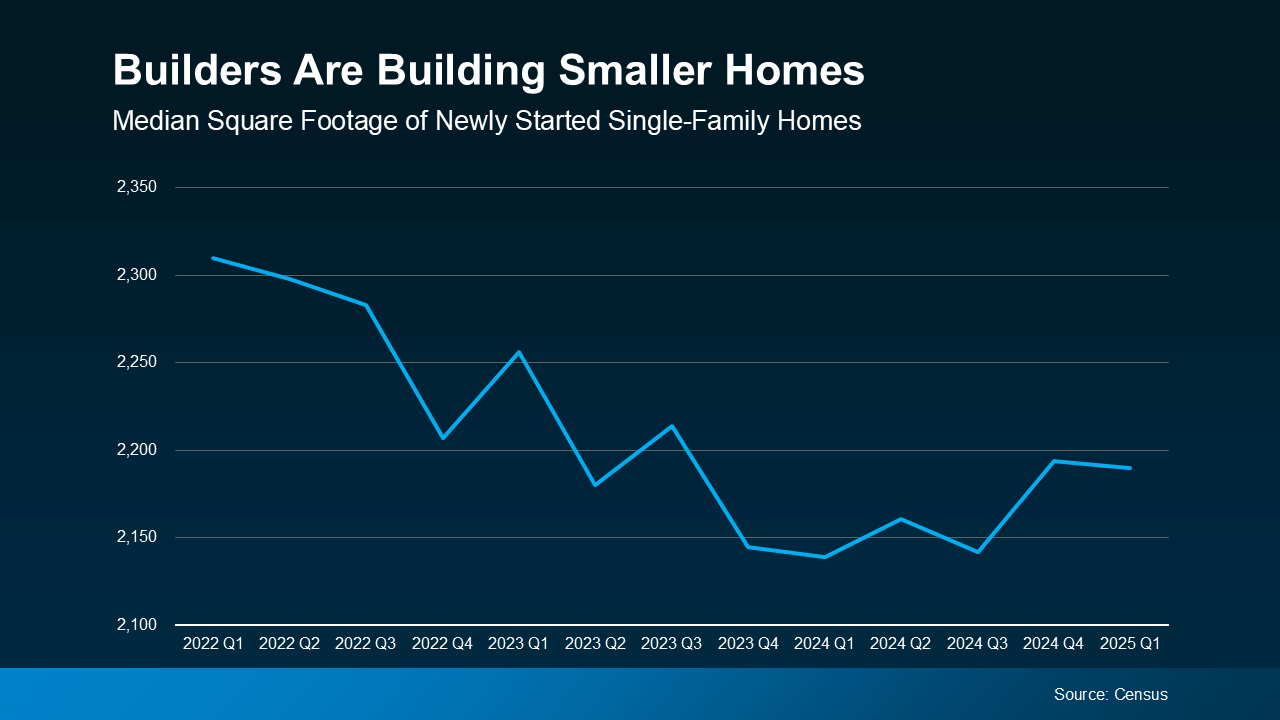

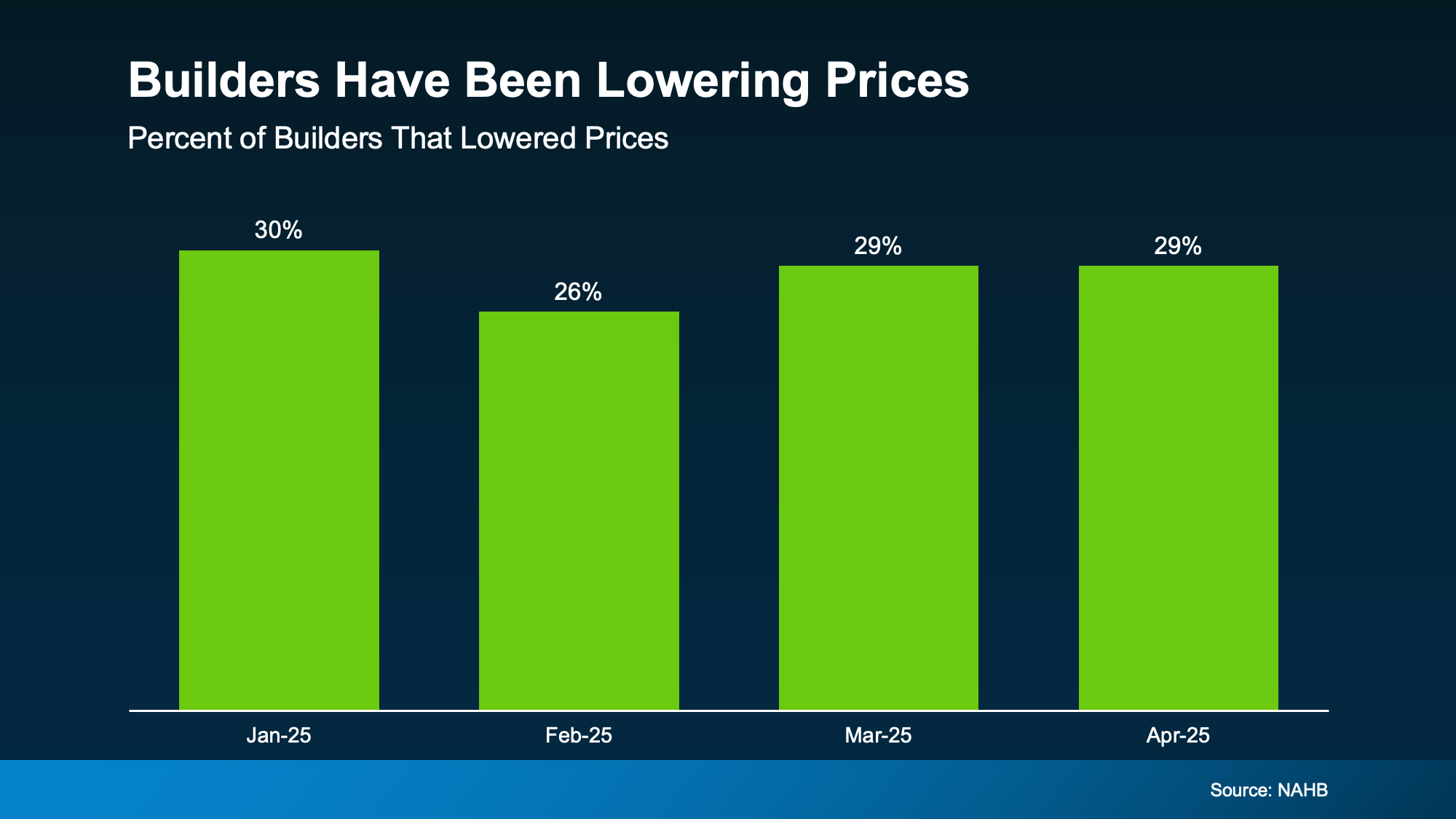

Newly Built Homes May Be Less Expensive Than You ThinkDo you think a brand-new home means a bigger price tag? Think again. Right now, something unique is happening in the housing market. According to the Census and the National Association of Realtors (NAR), the median price of newly built homes is actually lower than the median price for existing homes (ones that have already been lived in): 1. Builders Are Building Smaller Homes Builders know that buyers are struggling with affordability today. So, instead of building big houses that may not sell, they’re building smaller ones that will. According to the Census, the average size of a newly built single-family home has dropped considerably over the past few years (see graph below): 2. Builders Are Offering Price Cuts and Incentives In May, according to the National Association of Home Builders (NAHB), 34% of builders lowered their prices, with an average price drop of 5%. That’s because they want to be sure they’re selling the inventory they have before they build more. On top of that, 61% of builders also offered sales incentives – like helping with closing costs or buying down your mortgage rate. These are all ways builders are making their homes more affordable, so these homes sell in today’s market. If you're trying to buy a home right now, be sure to talk to your agent to find out what builders are doing in and around your area. They can find new home communities, as well as builders who are offering incentives or discounts, and hidden gems you might not uncover on your own. Plus, buying a newly built home often means there are different steps in the process than if you purchase a home that’s been lived in before. That’s why it’s so important to have your own agent who can explain the fine print. You want a pro in your corner to advocate for you, negotiate on your behalf, and make sure your best interests come first. You could get a home that’s brand new, with modern features, at a price that’s even lower than some older homes. Let’s talk about what you’re looking for and see if a newly built home is the right fit for you. If buying a home is on your to-do list, what would stop you from exploring newly built options?

|

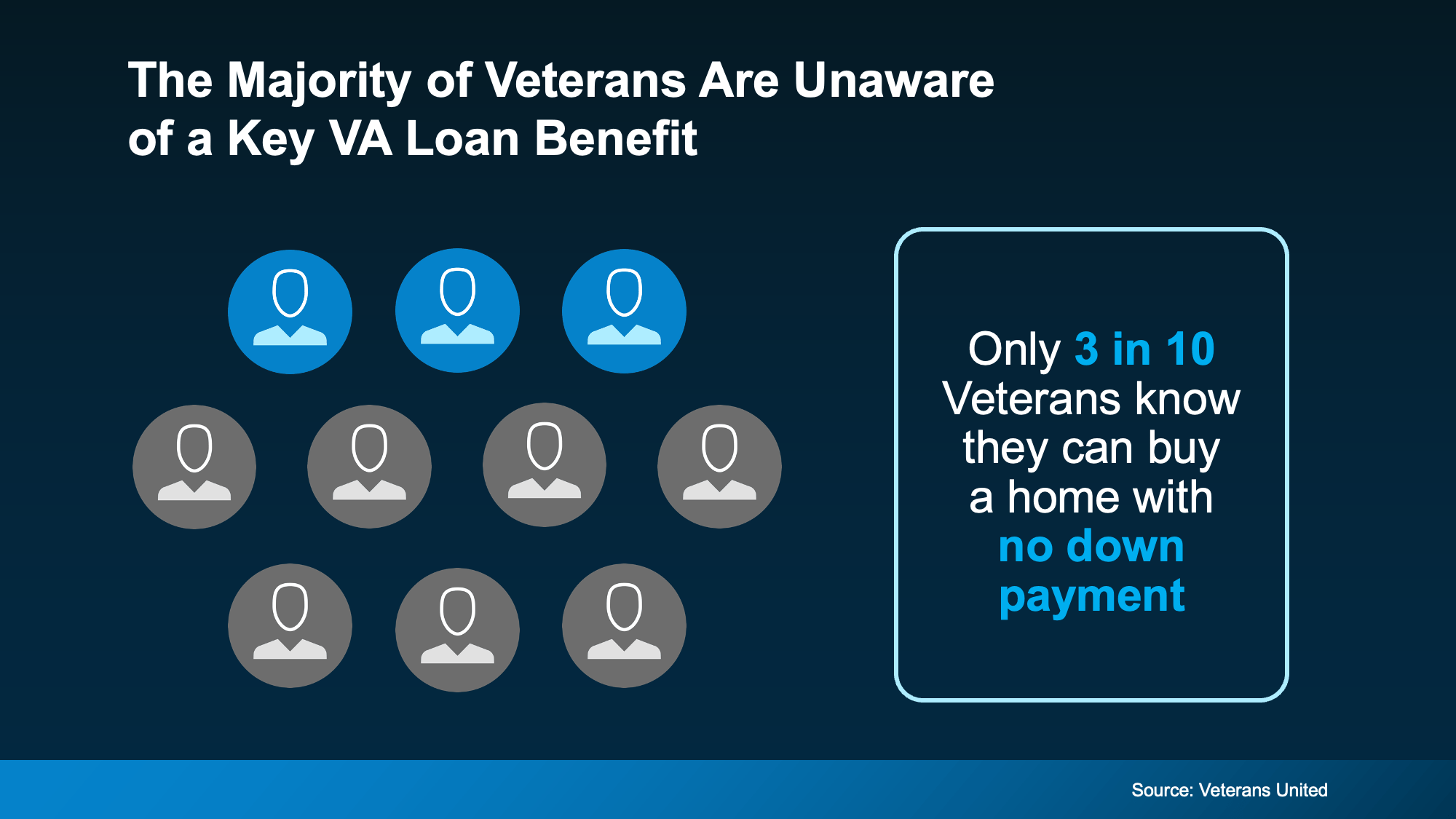

Many Veterans Don’t Know about This VA Home Loan BenefitFor 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don't know about one of its core benefits. According to a report from Veterans United only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below): That’s why it’s so important for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans: These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the Department of Veterans Affairs: If you want to learn more, your best resource for all the options and advantages of VA loans is your team of expert real estate professionals, including a local agent and a trusted lender. VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan. Do you know if you’re eligible for a VA home loan? Talk to a trusted lender who can help you see if you’d qualify.

|

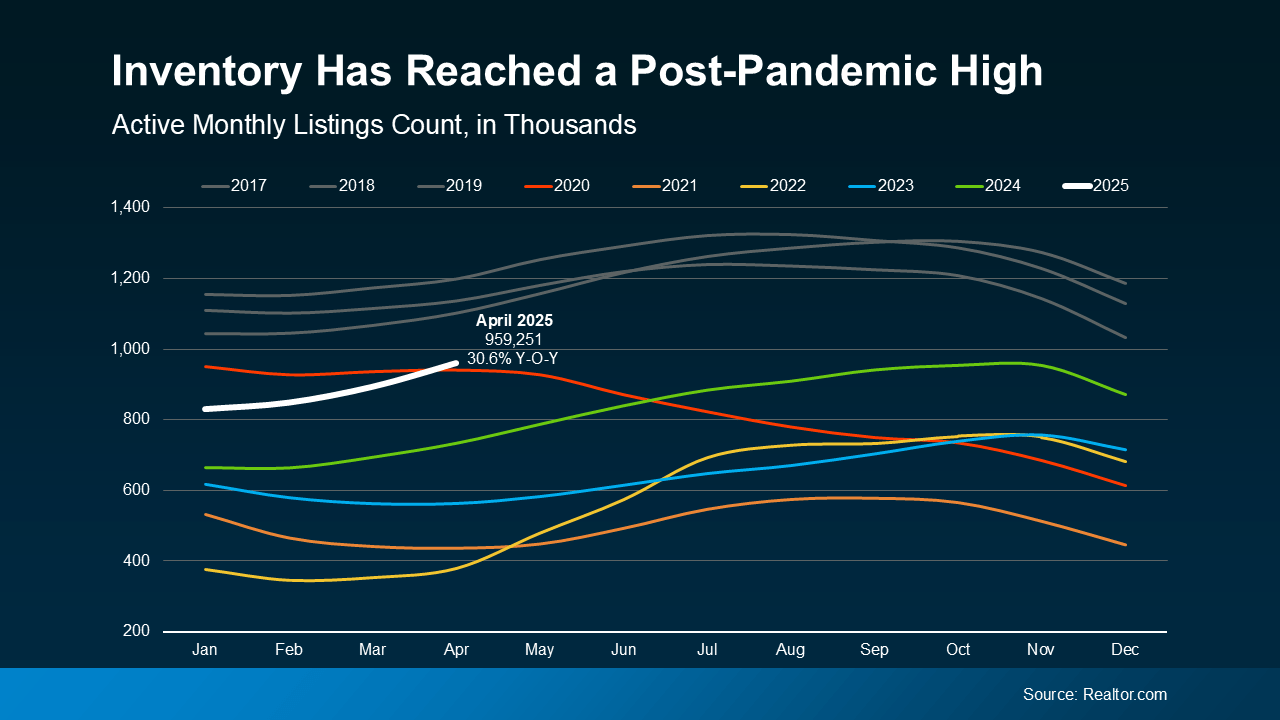

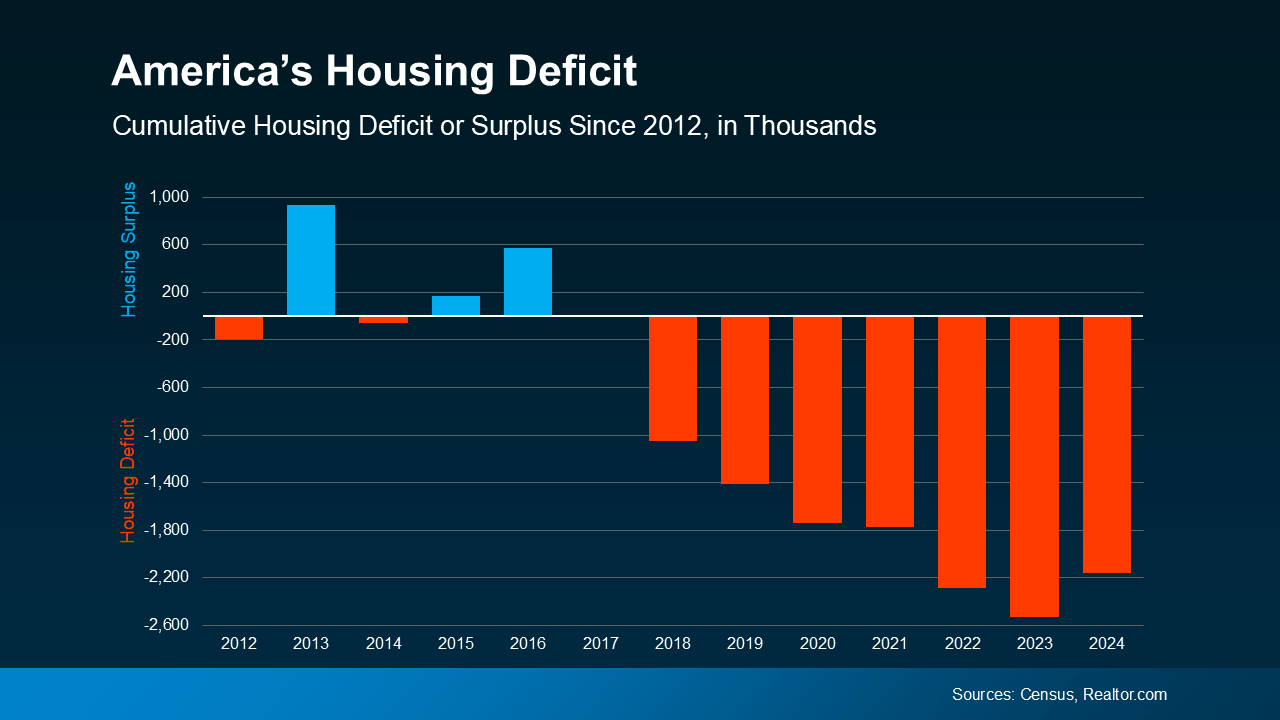

More Homes for Sale Isn’t a Warning Sign – It's Your Buying OpportunityMaybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash. But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news. It’s actually a sign of the market returning to a more stable, healthy place. Based on the latest data from Realtor.com, inventory just hit its highest point since 2020, shown with the white line in the graph below. But what you need to realize is, at the same time, inventory levels still haven’t returned to pre-pandemic norms (shown in gray): And while it’s true inventory is up significantly compared to where it was over the last few years, the number of homes on the market is still well below typical levels. And that’s important context. Some people hear inventory’s rising and immediately think about 2008. Because back then, inventory spiked just before the market crashed. But today’s situation is very different. Here’s the key reason why. We don’t have a surplus of homes; we have a deficit to climb out of. What we’re dealing with is a long-term housing shortage – and it’s a big one. The red bars in the graph below show all the years where housing starts (new builds) didn’t keep up with household formation, going all the way back to 2012. The deeper the bars in the graph, the more the housing deficit grew (see graph below): That means, in most areas, there isn’t a risk of having too many houses on the market right now. It’s quite the opposite – a vast majority of markets actually need more homes. Which is why, even though inventory is rising, it’s not a problem on a national scale. It’s just helping to fill a gap that’s been growing for years. Don’t let the headlines scare you. Rising inventory isn’t a sign of a crash. It’s a step toward a more normal, stable housing market.

|

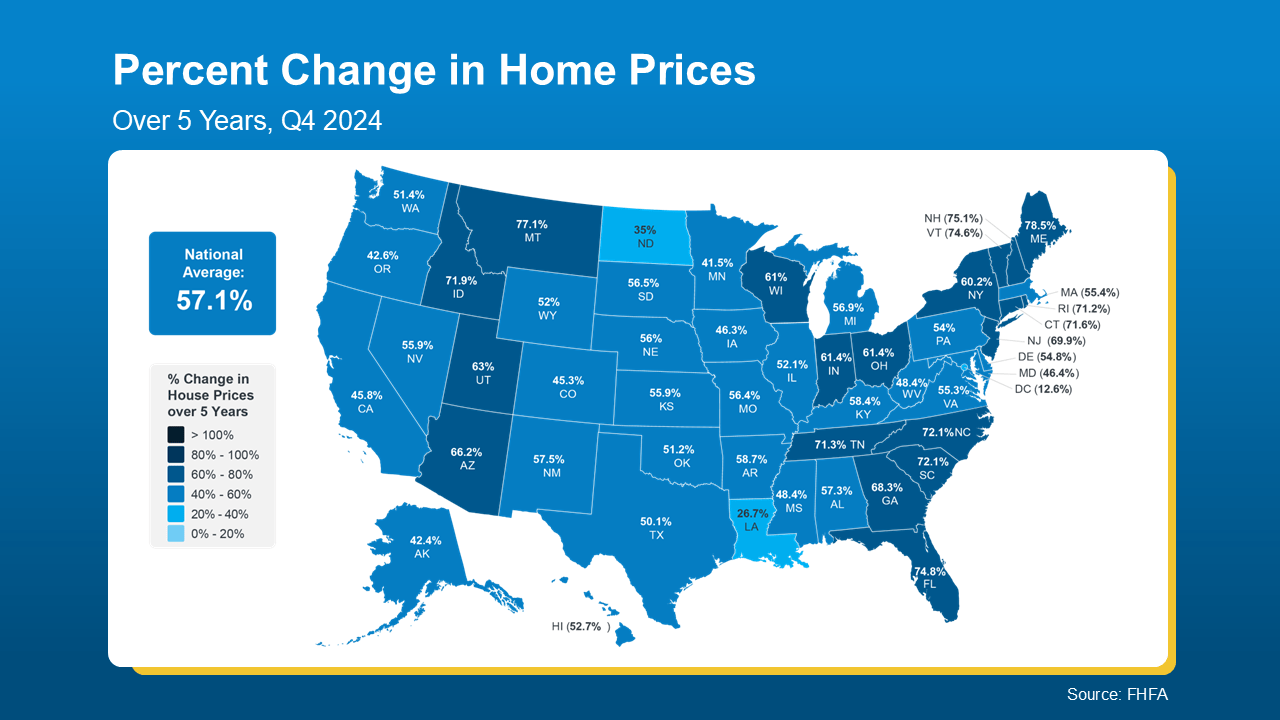

Why Buyers Are More Likely To Get Concessions Right NowEspecially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive. When a seller or builder gives you something extra to help with your purchase, that’s called either a concession or an incentive. Today, some of the most common ones are: For buyers, getting any of these things thrown in can be a big deal – especially if you’re working with a tight budget. As the National Association of Realtors (NAR) says: It’s not just one builder willing to toss in a few extras. A lot of builders are using this tactic lately. As Zonda says: That’s because they don’t want to sit on inventory for too long. They want it to sell. And according to the National Association of Home Builders (NAHB), one of the strategies many builders are using to keep that inventory moving (and not just sitting) is a price adjustment (see graph below): This isn’t a sign of trouble in the market, it’s an opportunity for you. The fact that the majority of builders offer incentives and roughly 3 in 10 are lowering prices means if you're looking at a newly built home, your builder will probably try to make it easier for you to close the deal. More existing homes (one that someone has lived in before) have been hitting the market, too – which means sellers are facing more competition. That’s why over 44% of sellers of existing homes gave concessions to buyers in March (see graph below): But remember, concessions don’t always mean a big discount. While more sellers are compromising on price, that’s not always the lever they pull. Sometimes it’s as simple as the seller paying for repairs, leaving appliances behind for you, or helping with your closing costs. And considering that home values have risen by more than 57% over the course of the past 5 years, small concessions are a great way for sellers to make a house more attractive to buyers while still making a profit. Whether you’re looking at a newly built home or something a little older, there’s a good chance you can benefit from concessions or incentives. If a seller or builder offered you something extra, what would make the biggest difference to help you move forward? Let’s talk about it and see if it’s realistic based on inventory and competition in our local market.

|

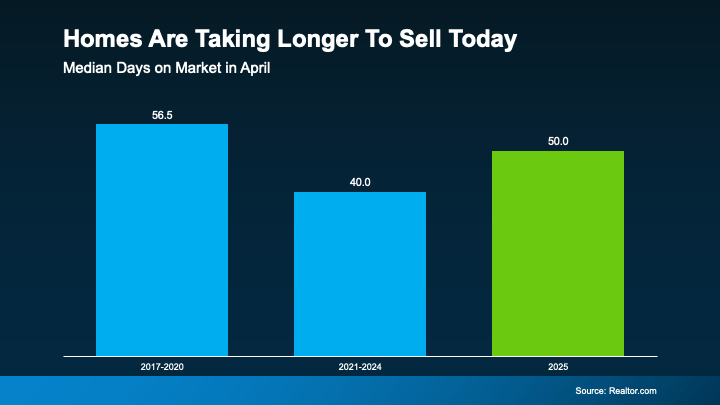

Homes Are Still Selling Faster Than Pre-PandemicAs you think ahead to your own move, you may have noticed some houses sell within days, while others linger. But why is that? As Redfin says: That may leave you wondering what you should expect when you sell. Let’s break it down and give you some actionable tips on how to make sure your house is one that sells quickly. The first thing you should know is that, in most markets, things have slowed down a little bit. While you may remember how quickly homes sold a few years ago, that’s not what you should expect today. Now that inventory has grown, according to Realtor.com, homes are taking a bit longer to sell in today’s market (see graph below): By this comparison, if your house does take a little more time to sell this year, it’s not really a concern. It’s actually still faster than the norm. Plus, it gives you a bit more time to find your next home, which is welcome relief when you’re trying to move, too. Just remember, some homes sell in less time than this. Some take even longer. So, what’s the real difference? Why do some homes attract eager buyers almost instantly, while others sit and struggle? It comes down to having the right agent and strategy. Here are a few tips you need to know. One of the biggest reasons homes sit on the market is overpricing. Many sellers want to shoot for a higher price, thinking they can lower it later – but that backfires by turning buyers away. What to do: Work with an agent to make sure your house is priced right. They’ll analyze recent comparable sales (what other homes have sold for recently in your area), so you know you're pricing appropriately for today’s market and what buyers are willing to pay. As Chen Zhao, Economic Research Lead at Redfin, explains: A messy yard or a house that needs paint? It’ll turn buyers off. Since buyers decide within seconds whether they like a home, a good first impression is key. What to do: Outside, clean up your front yard, tidy up your landscaping, power wash walkways, and add fresh mulch. Inside, declutter and depersonalize. And consider minor touch-ups like repainting in a neutral tone. Your agent will offer advice on what to tackle. If your listing or your photos don’t look professional, you could have trouble drawing in buyers who think you’re trying to cut corners. What to do: Instead, lean on your agent’s skills, expertise, and resources. They’ll help you make sure you have: You may have heard the phrase “location, location, location” when it comes to real estate. And there’s definitely some truth to that. Homes in highly sought-after neighborhoods tend to sell faster. What to do: While you can’t change where your house is located, your agent can highlight the best features of your neighborhood or community in your listing. By showcasing what’s great about your area, they can help draw buyers into what life would look like in your house. Homes that sell quickly don’t necessarily have better features – they have better agents and a better strategy.

|

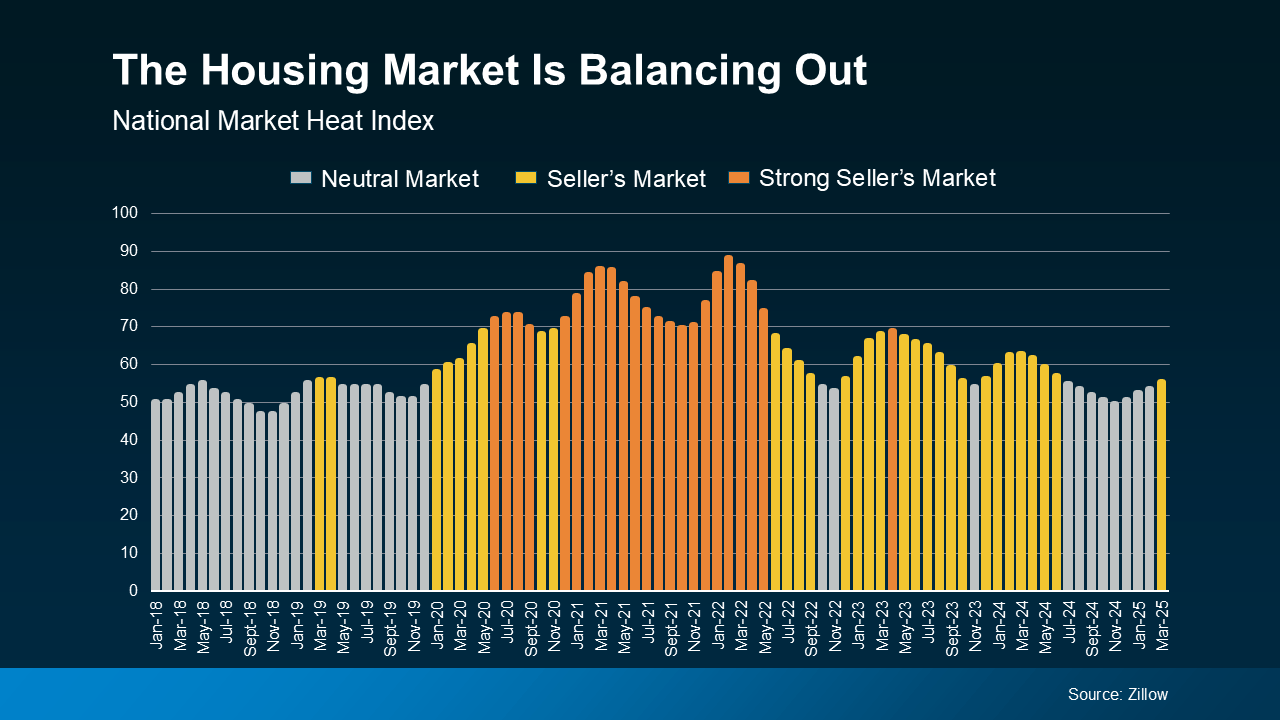

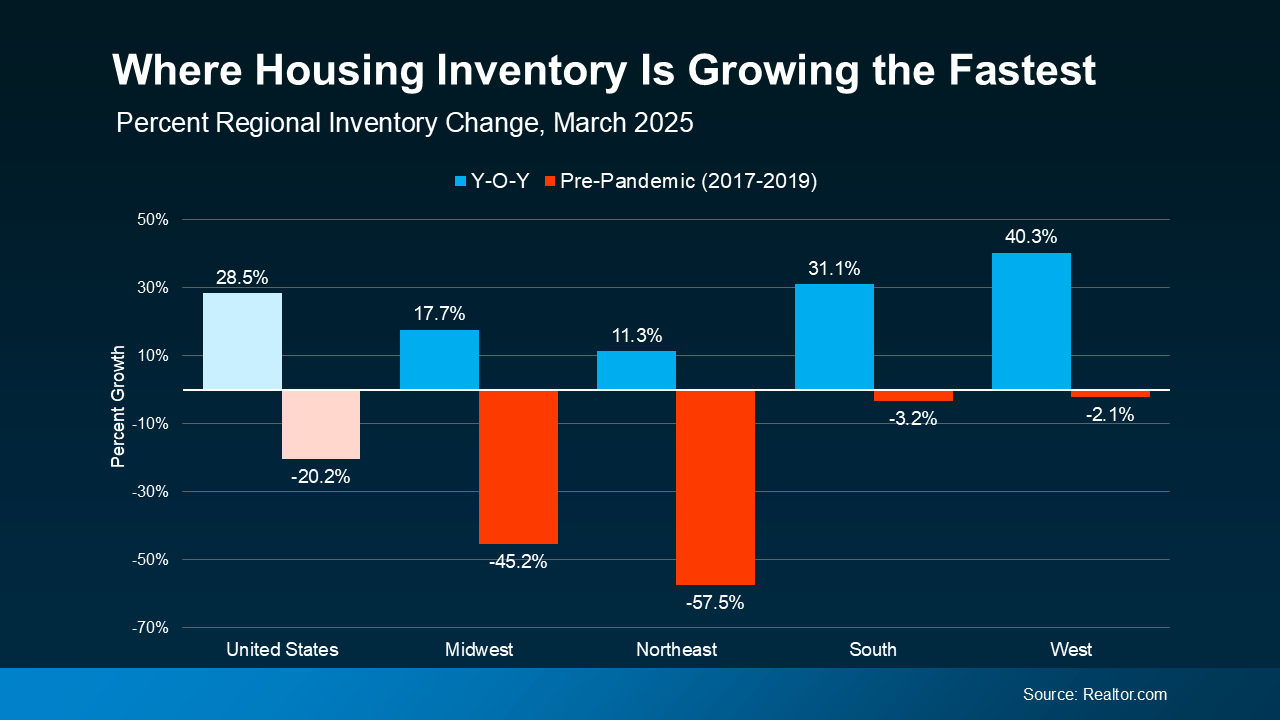

A Tale of Two Housing MarketsFor a long time, the housing market was all sunshine for sellers. Homes were flying off the shelves, and buyers had to compete like crazy. But lately, things are starting to shift. Some areas are still super competitive for buyers, while others are seeing more homes sit on the market, giving buyers a bit more breathing room. In other words, it’s a tale of two markets, and knowing which one you’re in makes a huge difference when you move. In a buyer’s market, there are a lot of homes for sale, and not as many people buying. With fewer buyers competing for these homes, that means they generally sit on the market longer, they might not sell for as much as they would in a seller’s market, and buyers have more room to negotiate. On the flip side, in a seller’s market, there aren’t enough homes for sale for the number of buyers who are trying to purchase them. Homes sell faster, sellers often get multiple offers, and prices shoot higher because buyers are willing to pay more to win the home. For years, almost every market in the country was a strong seller’s market. That made it tough for buyers – especially first-timers. But now, things are shifting. According to Zillow, the national housing market is balancing out (see graph below): The orange bars in the middle of the graph show the years when sellers had their strongest advantage, from 2020 to early 2022. But, as time has gone on, the market has become more balanced. It shifted from a strong seller’s market to a less intense one. And lately, it's been neutral more than anything else (that’s the gray bars on the right side of the graph). That means buyers are gaining some negotiating power again. In a more balanced or neutral market, homes tend to stay on the market a little longer, bidding wars are less common, and sellers may need to make more concessions – like price reductions or helping with closing costs. That shift gives today’s buyers more opportunities and less competition than a couple of years ago. Inventory plays a big role. When there are more homes for sale, buyers have more options – and that cools down home price growth. As data from Realtor.com shows, the supply of available homes for sale isn’t growing at the same rate everywhere (see graph below): The South and West regions of the U.S. have seen big jumps in housing inventory in the past year (that’s the blue on the right). Both are almost back to pre-pandemic levels. That’s why more buyer’s markets are popping up there. But in the Northeast and Midwest, inventory is still very low compared to pre-pandemic (that’s why those red bars are so big). That means those areas are more likely to stay seller’s markets for now. Every local market is different. Even if the national headlines say one thing, your town (or even your neighborhood) could be telling a totally different story. Knowing which type of market you’re in helps you make smarter decisions for your move. That’s why working with a local real estate agent is so important right now. As Zillow says: Agents understand the unique trends in your area and can help you make the best choices, whether you’re buying or selling. With their expert strategies, you can move no matter which way the market is leaning, because they know how to navigate various levels of buyer competition, how to find hidden gems locally, how to price a house right, how to negotiate based on who has more leverage, and more. If you're ready to make a move, or even just thinking about it, let’s connect. That way, you’ll have someone to help you understand our local market and create a game plan that works for you. What’s one thing you’re curious about when it comes to the market in our area?

|

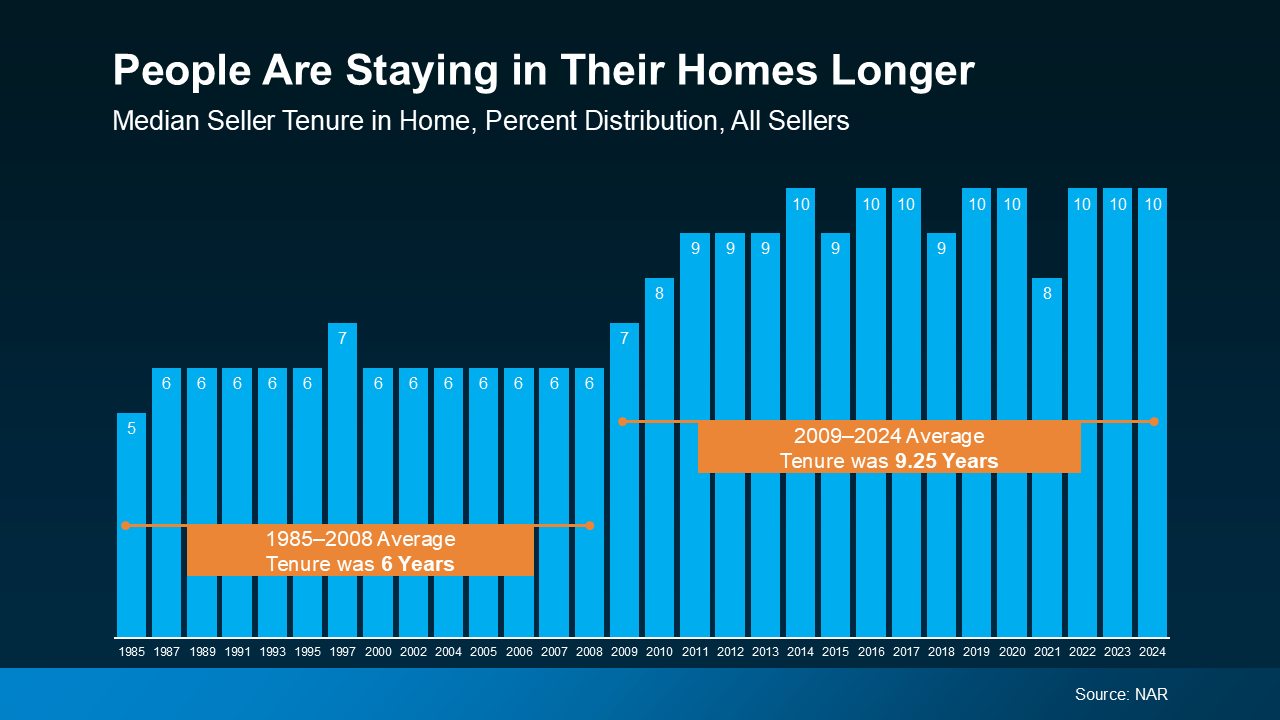

What’s Your House Worth Now? The Answer May Surprise YouLet’s talk about something you might not check nearly as often as your bank account – and that’s how much your home is worth. But when it comes to your financial situation, it’s an important thing to remember. When’s the last time you had a professional show you the value of your home? Think about it. For most people, your house is probably the biggest asset you have. And if you’ve owned your home for a few years (or longer), chances are it’s been quietly building wealth for you in the background. And honestly? You might be surprised by just how much. This wealth you may not even realize you have comes in the form of home equity. Home equity is the difference between what your house is worth and what you still owe on your mortgage. It grows over time as home values rise and as you pay down your mortgage each month. Here’s an example to help you really understand how this works. Let’s say your house is now worth $500,000, and you have $200,000 left to pay off on your loan. That means you have $300,000 in equity. And most homeowners are sitting on some pretty significant equity right now. According to Cotality (formerly CoreLogic), the average homeowner with a mortgage has about $311,000 in equity. Here are the two main reasons homeowners like you have record amounts of equity right now: 1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA), home prices have jumped by more than 57% nationwide over the last five years (see map below): 2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below): So, if you’re one of those people who’s been in their home for that long, here’s how much the behind-the-scenes price growth has helped you out. According to NAR: Remember, your house might be your biggest financial asset – and, if you’re smart about how you leverage your equity, it could open up some exciting opportunities for your future. Chances are, your house is worth a lot more than you realize. Whether you’re thinking about selling, upgrading, or simply want to understand your options, your equity isn’t just a number. It’s a tool. If you sold your house and had significant equity to work with, what would you do with it? Let’s figure out how to turn your home’s value into your next big move.

|

The Spring Guides for Buying or Selling a Home Are HereThe Spring Guides for buying or selling a home are here. Let’s connect so you can get the latest digital copies of these guides.

|

But inventory growth is going to

But inventory growth is going to

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate